| Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures we cannot take responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent. |

Thailand has introduced a Value Added Tax (“VAT”) system in 1992. Ultimately, the Thai VAT is an “all-phase net sales tax with input tax deduction authorisation”, similar to the system originally invented in Germany in 1916.

The rate of Thai Value Added Tax is currently at 7 %. These 7 percent are split into 6.3% Federal VAT and 0.7% Local Tax. While in sec. 80 of the Thai Tax Code a rate of 10% is stipulated, it has “temporarily” been reduced to 7% since 1999 to improve the economy by stimulating consumption. However, it has been prolonged ever since. The latest extension was issued in September 2023 with a provisional end date of 30 September 2024. However, for the time being there are no signs of this practice changing.

In principle, any sale of goods or services within Thailand is subject to VAT, provided that the (natural or juristic) person issuing the invoice is registered in the VAT system.

For invoices to foreign customers, the matter is a bit more complex.

The following combinations are possible:

- performed a service or work abroad, which is used abroad VAT exempt

- service or work performed in Thailand but used abroad 0 % Thai VAT

- service or work performed abroad but used in Thailand 7 % Thai VAT

- service or work performed in Thailand and used in Thailand 7 % Thai VAT

Examples:

I. Service or work is performed abroad, and is used abroad:

If a service or work is performed abroad and is used abroad, Thai VAT does not apply. This is for example the case if a Thai company sends a service engineer to Vietnam and invoices a Vietnamese customer.

II. Service or work is performed in Thailand and is used abroad (“export of Services”):

If a service or work is performed in Thailand and is used abroad a VAT must be added to the invoice. However, rate of the VAT is 0 %. This is for example the case if a consulting company based in Thailand drafts a feasibility study for a German company on a project in Vietnam.

But:

- Export of Service Definition: It needs to be noted that the definition of “being used abroad” is very narrow. Any link to the Thai market, from a Thai perspective, is seen as being used locally. Therefore, e.g. services in connection with a project in Thailand are subject to VAT even if the service recipient is based outside of Thailand. This is different to the definitions used by European countries.

- Transfer of ownership of intangible goods (i.e. transfer of ownership of rights in patent, a transfer of ownership of trademark, copyright, royalty) from Thailand to abroad shall not be regarded as a rendering of service in Thailand used abroad. Therefore, the Thai company has the duty to add 7% VAT on its invoice to the (foreign) customer abroad.

- However, if a Thai company has permitted any company abroad to use rights (patents, etc.), whereby the Thai company is still the owner of the aforesaid rights, it shall not be regarded as a sale of intangible goods. It shall be regarded as a rendering of service in Thailand used abroad and VAT must be added. However, the VAT rate is 0%.

III. Service or work is performed abroad and is used in Thailand:

In case a foreign registered company has performed service or a work abroad and the service or work is used in Thailand, it shall be regarded as if the service or work was performed in Thailand. however, unless the foreign registered company is VAT registered in Thailand (i.e. a branch office), it cannot add VAT on its invoices. In such cases, the service recipient in Thailand is obliged to submit VAT on the service provider’s behalf, however, can claim such amount as input VAT (so-called Reverse Charge Mechanism, submitted via Form P.P. 36)

Transfer of ownership of intangible goods (i.e. transfer of ownership of rights in patent, a transfer of ownership of trademark, copyright, royalty) from abroad into Thailand shall not be regarded as a rendering of service abroad used in Thailand. Therefore, while a VAT must be added, however the VAT rate is 0%.

But: If the company registered abroad has permitted any Thai Company or any person in Thailand to use rights, of which the company is remains the owner of the said rights, it shall not be regarded as a sale of intangible goods. It shall be regarded as a rendering of service abroad used in Thailand. Therefore, the foreign company has the duty to add 7 % VAT to its invoice to the (Thai) customer.

IV. Service or work performed in Thailand, used in Thailand:

If a service or work is performed in Thailand and is used in Thailand, the standard 7% VAT rate shall apply.

However, there are certain VAT exempted businesses (Revenue Code, Div.4, Sec. 81).

These include:

Sale of:

- agricultural products, animals, fertilizers, fish meals,

- animal feeds, drugs and chemical products of plants and animals,

- newspapers, magazines, textbooks,

- goods or provision of services by a ministry department,

- goods or provision of services exclusively for the benefit of a religion, or

- a public charity in Thailand, of which the profits are not applied for other purposes, goods or provision of services designated by a royal decree.

Provision of:

- educational services, an artistic and cultural service in the branch,

- services by practicing arts of healing, auditing, advocacy in courts,

- services in healing and nursing by a clinic under law governing clinics,

- research or technical services in the branch, library, museum, or zoological garden services,

- services under an agreement on hire of service,

- services of organizing amateur sports contests,

- services of public entertainers, only if being the service in the branch,

- services of domestic and international transport, not being transport by means of aircraft or sea-going vessels,

- services of letting out an immovable property on hire

- services by a local government authority, not including its commercial services or services for seeking revenues or benefits, regardless of whether or not being a public utility.

Import of the following goods:

- agricultural products, animals, fertilizers, fish meals,

- animal feeds, drugs and chemical products of plants and animals,

- newspapers, magazines, textbooks,

- goods from a foreign country that are brought into an export processing zone, only if the goods are exempt from import duty,

- goods listed in the part on the goods exempted from duty under the law governing customs tariff,

- goods imported and kept under the custody of the Customs Department,

- export of goods or provision of a service by a registrant liable to value added tax under Sec. 82/16, RC,

A small company with an annual turnover less than 600,000 THB

(Revenue Code, Div. 4 Sec. 81/1)

V. Calculation of VAT

The main problem, however, is how to calculate the amount of VAT that a Thai company has to pay to the Revenue Department (“RD”). The formulas will be explained in the following.

1. Principles

To understand the below formulas there is a need to clarify the used terms.

“Output Tax” is the received VAT amount (received from customers).

“Input Tax” is the paid VAT amount (paid to supplier).

The general calculation of the amount that has to be paid to the Revenue Department on a monthly basis is as follows:

Output Tax – Input Tax = tax debt (to pay monthly)

In case the tax debt is negative, the tax debtor can claim this negative amount from the Revenue Department or may use it in the future as a tax credit.

2. Exception

It is important to distinguish between normal VAT (7%), 0 % VAT business and VAT exempted business!

“0 % VAT”-business has no impact on the claimability of input tax while VAT exempted business may lead to some input VAT not being claimable:

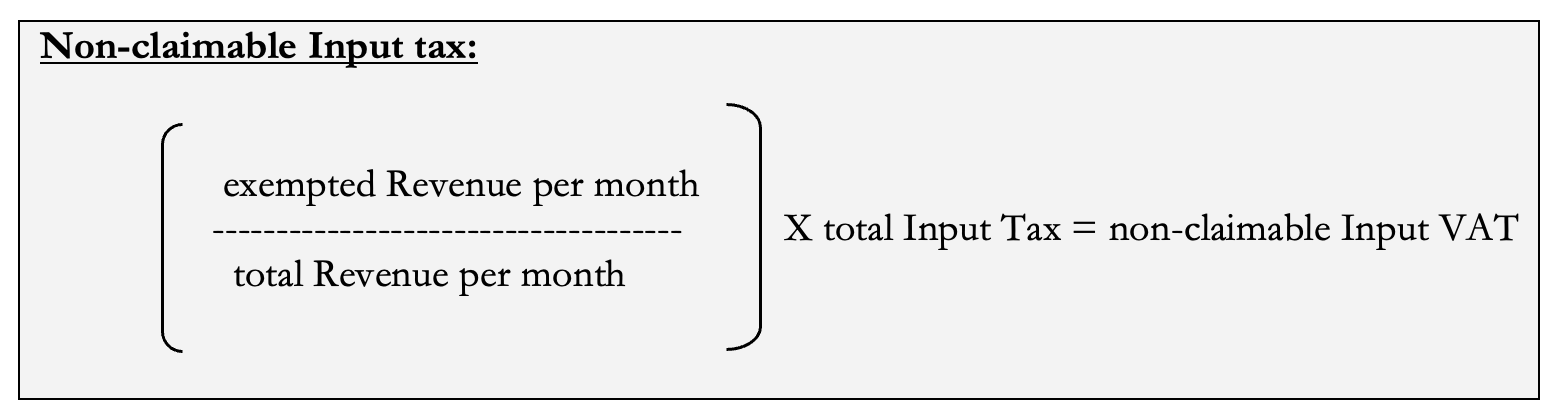

If more than 10 % of the company’s revenue is VAT exempted, then, the company’s claimable Input tax has to be reduced proportionally.

Example:

| VAT (7%) -Amount: |

To be used as |

||

Total Revenue |

100 THB | 7 | Output Tax |

| Thereof exempted revenue |

40 THB |

exempted |

Output Tax |

Total purchase |

80 THB | 5.6 | Input Tax |

40 THB

————- = 40% X 5.6 THB = 2,24 THB = non claimable Input VAT

100 THB

total VAT amount – non-claimable input VAT = claimable input VAT

5.6 THB – 2.24 THB = 3.36 THB

Amount of VAT be paid to the Revenue Department

Output VAT – claimable Input VAT = Amount of VAT to be paid

7 – 3.36 = 3.64 THB

Therefore, 3.64 THB must be paid to the Revenue Department (and not: 7 – 5.6 = 1.4 THB)