With the support of Haiwen & Partners – Beijing, China

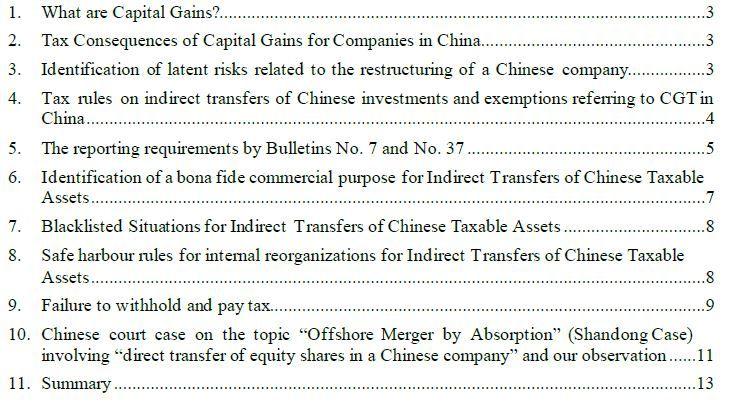

Table of content

Although Lorenz & Partners always pays great attention on updating information provided in newsletters and brochures, we cannot take any responsibility for the completeness, correctness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation with a qualified lawyer. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent. Besides, Haiwen & Partners holds the same position as presented by Lorenz & Partners above.

1. What are Capital Gains?

Capital gains are the (unrealized or realized) increase in value of a capital asset exceeding the initial investment (or purchase price). The gain is not realized until the asset is sold (or any other remuneration received). A capital gain may result from a short-term (one year or less) or long-term (more than one year) investments and may be subject to income taxes. While capital gains are generally associated with shares or funds due to their inherent price volatility, a capital gain can occur on any share or any asset that is sold/transferred for a price higher than the original investment/purchase price. Realized capital gains or losses occur when an asset is actually sold or transferred. Realized capital gains may trigger a taxable event. Unrealized gains and losses, sometimes referred to as paper gains or losses, reflect an increase or decrease in an investment’s value and this may trigger a taxable event as well. A capital loss is incurred when there is a decrease in the capital asset’s value compared to the asset’s purchase price. Under certain circumstances, such tax losses can be used and offset against taxable profits

2. Tax Consequences of Capital Gains for Companies in China

There is no separate or specific CGT in China for enterprises. Capital gains (and losses) of companies generally are combined with operating profits and usually taxed at the normal Enterprise Income Tax (EIT) rate of 25 %, unless a reduced EIT rate (e.g. 20%, 15%) applies to qualified enterprises under qualified circumstances. The taxable income of a Chinese enterprise generally includes operating profits, capital gains and passive income, such as interest, royalties and rents. Dividends received from a foreign entity must be included in the taxable income of a Chinese company as well. In this connection, foreign tax credit is allowed, which includes direct foreign tax credit and qualified indirect foreign tax credit.

3. Identification of latent risks related to the restructuring of a Chinese company

The ownership of a Chinese subsidiary by a non-resident company is often organized through an intermediary holding company in a third country/region. (such as Hong Kong, Singapore, Switzerland etc.) These ownership structures can provide tax advantages and easier management control and other synchronization effects.

Usually the profit is generated in the jurisdiction where the holding company is located or registered. Nevertheless, some jurisdictions apply capital gains tax in the country/region where the asset is registered or domiciled .Many agreements for the avoidance of double taxation on income and the prevention of fiscal evasion with respect to taxes on income and on capital (“DTA”) can allow the resident state/region of the company which is being sold (the asset) to tax this transaction as well.

For example, the DTA China-Germany states in Art. 13 (5):

Gains derived by a resident of a Contracting State from the alienation of shares (…) of a company which is a resident of the other Contracting State may be taxed in that other Contracting State if the first-mentioned resident, at any time during the 12-month period preceding the alienation has owned, directly or indirectly, at least 25 per cent of the shares of that company.

Similar regulations are contained in the DTAs with Singapore and Hong Kong.

In principle, China uses this right and taxes the sale of shares of a Chinese company by a foreign parent holding company at a rate of 10%. Chinese tax authorities also generally tax capital gains received by selling de facto a Chinese subsidiary by an indirect transfer, even if the transfer is only due to an internal restructuring and no money is received and no share price is paid in cash, unless safe harbour rules could be met.

Therefore, even internal corporate restructurings can trigger a negative tax impact.

However, there are some exceptions, which we would like to discuss based on the current legal regulations.

4. Tax rules on indirect transfers of Chinese investments and exemptions referring to CGT in China

The State Administration of Taxation (SAT) issued Circular No. 698 in 2009. Then the SAT issued Bulletin [2015] No. 7 in February 2015 and Bulletin [2017] No. 37 in October 2017.

Bulletin [2015] No. 7 abolished certain provisions in Circular No. 698 and provides more comprehensive guidelines on several issues when an indirect transfer by a non-resident enterprise becomes taxable in China. Bulletin [2017] No. 37 abolished the remaining parts of Circular No. 698 and certain term in Bulletin [2015] No. 7. In Bulletin [2015] No. 7 the term “ChineseTaxableAssets” appears for the first time. A non-resident enterprise that is transferring shares in its offshore holding company that directly or indirectly holds equity interests in a Chinese enterprise (Chinese Taxable Assets) may become subject to Chinese tax on any capital gains from the transfer.

The prerequisite is that the holding company owns (directly or indirectly) shares in a Chinese subsidiary and the transaction is classified as not having abonafide commercial purpose and therefore the tax authority may re-characterize the indirect transfer as a direct transfer of a Chinese enterprise/company.

However, Article 5 of Bulletin [2015] No. 7 specifies two situations/exemptions which create safe harbour rules:

– Normal trading of listed shares

Where a non-resident enterprise derives income from an indirect transfer of Chinese Taxable Assets by acquiring AND selling shares in an offshore public listed enterprise on a public market, such capital gains are not taxed in China.

– DTA or tax treaty exemption/exception

Where there is an indirect transfer of Chinese Taxable Assets, the income from the transfer will be exempt from EIT in China, if the applicable DTA or similar arrangement obliges China to exempt EIT under the case where the transferor would directly hold and sell the Chinese Taxable Assets.

Generally speaking, the exemption policy for the normal trading of listed shares are followed by the PRC tax authorities. In certain cases, if the acquiring of the listed shares is done via a block-trading approach (a block trade is an order for the sale or purchase of a large number of securities) and if the selling of shares is done in a going-private approach, certain tax authorities may aggressively challenge the “bona fide commercial purpose” of such transactions. In this connection, proper supporting documents and professional negotiation approach with the tax authorities are advisable.

With respect to the tax treaty exemption, we do see that in practice, certain cases enjoyed such exemption treatment. Upon properly preparing and submitting filing package with supporting documents, the tax preferential treatment is granted. Under the current administrative rules, after enjoying the tax treaty benefits, the tax authorities may require additional documents/information on a random-review basis, focusing on the cases with significant amount of exempted EIT.

5. The reporting requirements by Bulletins No. 7 and No. 37

The materials/information reporting requirement has been changed from mandatory under certain circumstances under Circular No. 698 to voluntary under Bulletin [2015] No. 7. However, the tax reporting and payment (withholding) obligation is (still) mandatory under Bulletin [2015] No. 7 if the Blacklisted Situations are met (please see Section 7 for the discussion of the Blacklisted Situations for Indirect Transfers of Chinese Taxable Assets for reference).

Under the old Circular No. 698, transactions had to be reported to the proper tax authorities if the actual tax burden in the country (region) where the overseas (intermediate) holding company being transferred is located is lower than 12.5% or income tax is not levied on its residents’ overseas income. Accordingly, within 30 days from the date of signing the equity shares transfer contract, the seller should provide the relevant materials/information to the competent tax authority where the Chinese resident enterprise being indirectly transferred is located.

Bulletin No. 7 generally does not contain an obligation to firstly report an “indirect transfer transaction” by the seller, but requires the buyer to firstly withhold PRC EIT for the seller under the Blacklisted Situations and then pay such withheld EIT to the competent tax authority. On the other hand, if the buyer fails to withhold EIT for the seller under the Blacklisted Situations, the seller needs by itself “to declare and pay the tax to the competent tax authority within 7 days from the date of the occurrence of the tax obligation and meanwhile provide related documents to the tax authority” (“7-day Self-report-pay-tax Requirement”).

The 7-day Self-report-pay-tax requirement was abolished by Bulletin [2017] No. 37. Bulletin [2017] No. 37 instead provides that if the non-resident enterprise (seller) fails to declare and pay tax, tax authority may order it to pay tax within a time limit, and under the circumstances that such non-resident enterprise obey the order by the tax authority, it will be deemed to have paid the tax on time (thus no penalty and late payment interest will be imposed) (“Compliance Under the Requirement of Tax Authority”).

With respect to the situations other than the Blacklisted Situations, a relevant party has the discretion whether to report a transaction or not, provided that the party believes such transaction is a “qualifying (non-tax) transaction” and therefore is not subject to taxation in China.

Obviously, if no filing is done, there is no guarantee on whether the transaction is secure. Without a China tax authority’s formal judgment, a self-assessed “qualifying (non-tax) transaction” might not be safe and the risk for future penalties remains, especially for the buyer (as the withholding agent), while the Compliance Under the Requirement of Tax Authority rule provides a bit more protection for the seller. For such reason, we recommend submitting the necessary documents to the tax authorities. This is of more importance for the buyer.

The Bulletin 7 extends the reporting parties. Under Circular No. 698, the reporting obligation was generally only imposed on the transferor (to report information and then may pay tax under certain circumstances)/the Chinese company whose equity shares are directly/indirectly transferred (to report information, under the case that the transfers of equity shares in multiple domestic or overseas holding companies simultaneously take place). Circular No. 698 did not clearly provide the obligation for the buyer (buyer’s obligation may have been provided by other tax regulations). Based on Bulletin [2015] No. 7, a transaction MAY be reported by either party to the transaction or by the Chinese enterprise whose shares are indirectly transferred; on the other hand, if the Chinese tax authorities request it (them), the above mentioned entities SHALL report relevant materials/information to the tax authority. According to Article 10 of the Bulletin [2015] No. 7, the Chinese tax authorities may request information about an indirect transfer from any of the parties involved, or from a planner of a transaction. This affects the duties of legal and tax consultants.

Bulletin [2017] No. 37 provides certain changes to the position of Bulletin 7, to encourage a seller to report and pay tax.

6. Identification of a bona fide commercial purpose for Indirect Transfers of Chinese Taxable Assets

Bulletin [2015] No. 7 provides a more detailed guidance on how to determine a bona fide commercial purpose. The Bulletin lists specific factors that need to be considered and describes blacklisted situations in which a transaction will be deemed to be lacking commercial purpose and therefore becomes taxable.

Article 3 of Bulletin [2015] No. 7 specifies that all arrangements related to an indirect transfer of Chinese taxable assets must be considered to qualify as bona fide transaction and lists the following specific factors:

➢ Whether the equity value of the non-resident holding company being transferred is mainly derived directly or indirectly from Chinese taxable assets;

➢ whether the assets of the non-resident holding company being transferred mainly consists directly or indirectly of investments in China;

➢ whether the revenue of the non-resident holding company being transferred is mainly derived directly or indirectly from China;

➢ whether the functions performed, and risks assumed by the non-resident holding company being transferred and its subsidiaries that hold Chinese taxable assets can justify the economic substance of the organizational structure;

➢ the duration of the shareholding and duration and changes of the business model;

➢ the duration of the relevant organizational structures of the non-resident holding company and how long it has been in existence;

➢ whether a foreign income tax is to be paid on the income from the indirect transfer of Chinese taxable assets;

➢ whether it would have been possible for the transferor to directly invest in and transfer the Chinese taxable assets rather than indirectly invest and transfer the Chinese taxable assets;

➢ if and how a tax treaty or an arrangement applies to the indirect transfer of the Chinese taxable assets;

➢ other relevant factors, if they are considered necessary by the tax authorities.

7. Blacklisted Situations for Indirect Transfers of Chinese Taxable Assets

A transaction is blacklisted if the following conditions are simultaneously fulfilled. In this case the transaction will be deemed as lacking a bona fide commercial purpose and therefore be subject to the CGT of 10 % in China.

➢ 75% or more of the equity value of the non-resident holding company being transferred is derived directly or indirectly from Chinese taxable assets;

➢ at any time during a one-year period before the indirect transfer of the Chinese taxable assets, 90% or more of the asset value (excluding cash) of the non-resident holding company being transferred (e.g. company registered in Singapore or Hong Kong) is comprised directly or indirectly of investments in China, or 90% or more of its income is derived directly or indirectly from China;

➢ the functions performed, and risks assumed by the non-resident holding company being transferred (and any of its subsidiaries) that directly or indirectly hold the Chinese taxable assets are limited and are insufficient to prove their economic substance;

➢ the foreign tax payable or actual tax paid on the gain derived from the indirect transfer of the Chinese taxable assets is lower than the potential Chinese tax on the direct transfer of such assets.

8. Safe harbour rules for internal reorganizations for Indirect Transfers of Chinese Taxable Assets

Article 6 of Bulletin [2015] No. 7 provides additional “Safe Harbour Rules” for indirect transfers due to internal reorganizations. An indirect transfer that satisfies the following conditions will be deemed to have a bona fide commercial purpose and not trigger a taxable event.

The transferor and the transferee are qualified in the following situations:

➢ The transferor directly or indirectly owns 80% or more of the shares in the transferee;

➢ the transferee directly or indirectly owns 80% or more of the shares in the transferor;

➢ or 80% or more of the shares of both the transferor and transferee are directly or indirectly owned by the same shareholder.

If more than 50% of the equity value of the non-resident holding company being transferred is derived directly or indirectly from Chinese real estates, the above mentioned holding percentages shall be 100%.

Besides, all the consideration paid by the transferee must originate from its own shares or shares of a related enterprise with which the transferee has a controlling relationship (excluding shares of listed companies). And in the case of an indirect transfer transaction which may occur after the current indirect transfer transaction, if comparing it with an identical or similar indirect transfer transaction under the circumstances that the current indirect transfer transaction would not occur, the PRC income tax burden should not be reduced.

This rule also requires no reduction of future PRC tax interests due to the proposed reorganization

9. Failure to withhold and pay tax

Bulletin [2015] No. 7 clarifies whether a party of the transaction has a withholding obligation on the payable tax. Say, Bulletin [2015] No. 7 clearly imposes a withholding obligation on the payer (“the unit or individual that is directly obligated to pay the relevant funds (money) to the transferor in accordance with the relevant laws or the contract is the Withholding agent”), which will be the transferee in most cases. Thus, in general the transferee will be the withholding agent.

Article 8 of Bulletin [2015] No. 7 specifies that as a general rule, if a withholding agent fails to withhold the payable taxes and the transferor also fails to pay, the tax authorities may hold the transferee as the withholding agent liable under the Chinese law. As mentioned in Section 5 of our article, Bulletin [2017] No. 37 provides a “Compliance Under the Requirement of Tax Authority” preferential rule for the seller. However, the buyer is not provided with such a preferential rule.

Bulletin [2017] No. 37 further specifies the following two different situations:

(1) The withholding agent fails to withhold the payable taxes

In accordance with Article 12 of the Bulletin [2017] No. 37, the competent tax authorities shall order the withholding agent to withhold the payable taxes and pursue liabilities of the withholding agent as per the Chinese law. If needed, the tax authorities may pursue the unpaid taxes from the transferor.

However, the above provision fails in providing detailed guidance on its implementation, such as whether the tax authorities can directly pursue payable taxes from the withholding agent or if it should first pursue the transferor. If the transferee has made full payment of the transfer price to the transferor, should the transferee as withholding agent still be liable for such withholding obligation?

Technically speaking, the failing of withholding tax by the buyer may lead to a penalty from 50% to 300% of the underpaid tax. According to Article 69 of the Law of the PRC on the Collection and Administration of Tax (LCAT), if a withholding agent should withhold but not withhold the tax, the tax authority shall recover the tax from the taxpayer, and the withholding agent shall be liable for the tax that should be withheld but not withheld with a penalty from 50% to 300% of the underpaid tax.

According to Article 8 of Bulletin [2015] No. 7, the liabilities of the withholding agent may be reduced or waived if it completes document filing as per Article 9 of Bulletin [2015] No. 7 within 30 days after the transfer agreement has been signed.

The risk of facing such liabilities should motivate the transferee in a transaction to report the transaction or at least to negotiate with the transferor on how to protect itself against such a risk.

(2)The withholding agent has withheld the payable taxes, but has failed to pay the same to the taxauthorities

Article 14 of the Bulletin [2017] No. 37 specifies that in any of the following circumstances, the withholding agent shall be deemed as having withheld but not paid the tax (“WBNP” Rule):

➢ Where the withholding agent has clearly told the payee that the tax due has been withheld;

➢ Where the withholding tax due has been listed separately in the financial and accounting books;

➢ Where it has separately deducted the tax in its tax returns or has started to separately amortize and deduct the deductible tax;

➢ Other evidence that the tax has been withheld.

In such case, as per Article 68 of the LCAT, the competent tax authorities shall pursue the withholding agent for taxes and penalties (a fine of more than 50% and less than 500% can be imposed, under certain circumstances). This implies that the transferor shall be released from liabilities under the above mentioned scenarios. However, please note that since Bulletin [2017] No. 37 governs a comprehensive range of items which attract withholding tax, such as direct transfer of shares, indirect transfer of shares, payment of dividends, loan interests, rents, royalties and etc., the possibility of being protected by the WBNP Rule for the transferor needs further analysis under specific situations.

In addition, according to Article 32 of the LCAT, if the withholding agent fails to pay the tax within the prescribed time limit, a late payment interest of daily 0.05% of the overdue tax will be imposed from the date of the overdue tax payment.

In comparison, as mentioned in Section 5 of our article. Bulletin [2017] No. 37 provides a bit more protection for the seller under the Compliance Under the Requirement of Tax Authority rule. This means, the seller has a chance to pay no penalty and no late payment interest under certain circumstance, while the buyer (as the withholding agent) only has a chance to be reduced or waived penalty if it completes document filing within 30 days of signing the transfer document.

10. Chinese court case on the topic “Offshore Merger by Absorption” (Shandong Case) involving “direct transfer of equity shares in a Chinese company” and our observation

In December 2015, a Chinese district court ruled that an offshore upstream merger which was carried out by two Italian companies was disqualified from receiving the tax-free treatment under Circular No. 59 (issued by the SAT on 30 April 2009).

An Italian parent company passed a resolution to merge with its wholly owned Italian subsidiary. As a result of the merger, the Italian parent company as the surviving company acquired all the Italian subsidiary’s assets and debts including the 33% shares in a Chinese resident company. The Italian subsidiary was deregistered after the merger. Afterwards, the Chinese tax bureau issued a notice to the Italian parent company, which stated that the merger had resulted in a taxable Chinese share transfer. Thus, the tax bureau taxed the internal restructuring with a CGT of 10% with regard to the 33% shares in the Chinese resident company.

However, the Italian parent company thought that the merger had satisfied the conditions for the tax-free treatment in Article 5 of Circular No. 59 and therefore should not trigger EIT liability in China.

After requesting a revocation at the tax authorities, the Italian parent company brought the case to court. The tax authorities declined the request with the argument that the transfer did not meet the additional conditions in Article 7 of Circular No. 59 limits qualifying cross-border share or asset acquisitions to the following three scenarios:

➢ A transfer of the shares of a Chinese company by a non-resident company to its wholly owned non-resident subsidiary (foreign-to-foreign reorganization), where the transferor holds the shares of the subsidiary for a minimum of a three-year period after the transfer;

➢ or a transfer of the shares of a Chinese company by a non-resident company to its wholly owned Chinese subsidiary;

➢ or a transfer of the assets of a Chinese company to its wholly owned non- resident subsidiary.

The court held that it was proper for the tax bureau to characterize the restructuring as a share transfer based on the following reasons:

➢ The merger led directly to a change of ownership of more than 33% of the shares in the target company and Bulletin No. 72 (published on 12 December 2013) states that a transfer of shares following an offshore merger means a transfer of shares by a non-resident company.

➢ for a qualification of a tax-free treatment, Article 7 of Circular No. 59 requires for a cross-border share that the transferor holds 100% of the shares in the offshore transferee. Whereas in this case (Shandong Case), it was the other way around. The transferee was holding 100% shares in the transferor. There- fore, the court held that the offshore merger was disqualified from receiving the tax-free treatment.

In August 2016, the court of second instance dismissed the appeal of the Italian company and the original judgment was upheld.

This case has been actively discussed among tax professionals in China. To our opinion, given the nature of a merger and the specific holding structure patterns, it seems that the condition that requires the transferor hold 100% of the shares in the offshore transferee should not apply to a Merger or a Demerger. This term under Circular No. 59 originally applies to the cases of Equity Acquisition and Assets Acquisition, while Circular No. 59 regards Merger and Demerger as separate transaction patterns besides the Equity Acquisition and Assets Acquisition.

Bulletin No. 72 provides that Article 7 of Circular No. 59 also applies to Merger and Demerger. This is originally to provide fair tax treatment for the cross-border reorganization including Merger and Demerger.

Since the commonly occurred types of cross-border reorganizations in the market in 2009 (i.e., the year during which Circular No. 59 was issued) were quite limited, the cross-border Merger and Demerger was not fully considered under Circular No. 59.

Accordingly, a Demerger is in nature impossible to satisfy the condition that the transferor holds 100% of the shares in the offshore transferee as prescribed in Article 7 of Circular 59. Under a normal case, before the Demerger, there is not an existing transferee to take over the being transferred Chinse subsidiary. As a result of a Demerger, 2 offshore sister entities are under common control of their parent company, thus, one sister company is impossible to be another sister company’s 100% shareholder. In this connection, if Bulletin No. 72 is serious about allowing applying “special tax treatment” (tax free) to a Demerger, then the condition of “transferor holds 100% of the shares in the transferee” shall be explained not apply to a Demerger. Otherwise, there may be not a single cross-border Demerger ever being able to enjoy the special tax treatment, and thus this will be clearly in conflict with the intention of Bulletin No. 72. Similarly, the above mentioned condition under Article 7 of Circular No. 59 shall not apply to a Merger as well. There is no meaning from tax aspects to allow an offshore subsidiary to absorb its offshore parent which holds a Chinese entity but not allow an offshore parent company to absorb its offshore subsidiary which holds a Chinese company.

It remains to be seen how the jurisprudence and practice will develop regarding to this topic. Obviously, professional discussions and suggestions may have positive impacts on the attitude of tax authorities and courts of laws toward specific tax topics. We do see certain interactions between the government and the tax professionals these years in China.

11. Summary

➢ In practice, for the indirect transfer of Chinese assets, there are opportunities and successful cases which enjoy the safe harbour rule treatment.

➢ To enjoy the preferential treatment, proper supporting documents are required. Technically speaking, tax planning may also be practical under certain circumstances.

➢ With respect to the cross-border demerger and merger due to internal reorganization, there may be arguable rooms with the tax authorities to enjoy the tax free treatment. However, the practice of handling tax matters varies quite a lot between different cities in China.

➢ To negotiate the tax disputes with the tax authorities in China, we see quite a few cases were handled not by tax professionals.

➢ Tax reporting and withholding terms need to be properly provided in the transaction documents.