Dear readers,

The acquisition of real estate in Thailand is only possible to a very limited extent for foreigners.

Essentially, the acquisition is only permitted for economic purposes, in particular through a Board of Investment promotion. For residential purposes, the acquisition of land by legal means is hardly realizable, but foreigners can acquire full ownership of condominiums.

The option of acquiring land via a Thai spouse is either not legal or only possible without collateral for the foreign spouse.

We take the liberty to point out that, despite all efforts to be correct, we cannot accept any liability for the content of this brochure and reserve all rights to the brochure and its contents with regard to copyrights. However, copies with mentioning the author’s name are welcome.

Thank you for your interest

Lorenz & Partners

Table of Contents

| I. | Introduction | 4 |

| II. | Ownership of Land and Buildings | 5 |

| 1. | Ownership by Individuals | 5 |

| 1.1 | Ownership of Land | 5 |

| 1.2 | Ownership of Buildings | 9 |

| 2. | Ownership by Companies | 9 |

| 2.1 | Land Acquisition outside of Industrial Zones | 9 |

| 2.2 | Land Acquisition in Industrial Zones | 11 |

| 2.3 | Land Acquisition through BOI Promotion | 11 |

| III. | Formalities | 12 |

| 1. | Land Purchase | 12 |

| 1.1 | Purchase Agreement | 12 |

| 1.2 | Land Documentation | 12 |

| 1.3. | Registration | 13 |

| 1.4 | Land Purchase in Industrial Zones | 14 |

| 2. | Condominium Purchase | 14 |

| 2.1 | Basics | 14 |

| 2.2 | Proof of Ownership | 14 |

| 2.3 | Transfer of Ownership | 15 |

| IV. | Rental for Residential and Business Purposes | 15 |

| 1. | Rental for Commercial and Industrial Purposes | 15 |

| 2. | Rental for Residential Purposes | 16 |

| 3. | Other Legal Constructs | 16 |

| 3.1 | Arsai | 16 |

| 3.2 | Usufruct | 17 |

| 3.3 | Superficies | 17 |

| 3.4 | Sub-Ing-Sitthi | 17 |

| V. | Taxes related to the Purchase of Real Estate | 17 |

| 1. | Specific Business Tax | 18 |

| 2. | Local Tax | 18 |

| 3. | Government Transfer Fee | 18 |

| 4. | Stamp Duty | 18 |

| 5. | Withholding Tax | 18 |

| VI. | Annual Taxes for Land Owners | 21 |

| Annex | 24 |

I. Introduction

There are various reasons why foreigners in Thailand may wish to acquire land or real estate, e.g. to create a holiday or retirement home, or for companies that are looking for a secure base for further investment.

The acquisition of land is basically not permitted to foreigners in Thailand. An exemption in the Land Code allows the acquisition of a limited-sized property with approval by the responsible minister and strict additional requirements.

However, in practice, the regulations of the Land Code lead to a ban on land

acquisition by foreigners.

This prohibition is due to the still existing fears of the Thai government that,

especially in the main economic centres and tourist areas, a sell-off of properties could occur, since land prices are still relatively low from a Western perspective.

However, the acquisition of buildings or land is not completely impossible. Under certain conditions, opportunities exist for foreigners to acquire ownership of buildings or land. It should be noted, however, that these exemptions are interpreted by the state authorities very restrictive, and land acquisition is subject to strict state supervision.

In this brochure, we will outline which possibilities exist for the acquisition and how a purchase can be practically carried out. In each case, the acquisition by private individuals is to be distinguished from the acquisition by companies.

II. Ownership of Land and Buildings

1. Ownership by Individuals

1.1 Ownership of Land

Private individuals are finding it difficult to acquire ownership of land in Thailand. Nevertheless, in various ways, usually with illegal constructs, attempts are made to acquire land and to circumvent the law. However, due to the wide range of control options and the ever-increasing willingness on the part of the authorities to actually carry out controls, we strongly advise against illegal constructs. In particular, a lawyer should always be consulted prior to actual acquisition to ensure that the money invested is not ultimately lost.

a) Ownership under Sec. 86 seq. Land Code

The acquisition of property under Sec. 86 seq. of the Thai Land Code presupposes a contract between Thailand and the home country of the acquirer, which permits the acquisition of landed property. The last of these contracts, however, was terminated in February 1970 and Thailand has since concluded no such contracts.

A way of acquiring land for residential purposes of up to 1,600 square meters

(1 Rai) is stipulated in Sec. 96 bis and Sec. 96 ter. Such acquisition requires a ministerial permission and shall meet the following conditions:

- THB 40 million will be invested in Thailand[1];

- this investment is beneficial for the Thai economy and society; and

- the invested capital shall remain in Thailand for at least five years.

In practice, this option is only open to a few foreigners. In addition, it is basically limited to urban residential areas (Bangkok Metropolis and Pattaya City).

Otherwise, a confirmation from the respective Provincial Office of Town and Country Planning must be obtained that the land to be acquired is located in an area designated as a residential area.

__________________________________

If the foreigner does not use the land for residential purposes within 2 years from the date of registration, the Director-General of the Land Department has the

[1] Examples for investments are:

- purchase of Thai Government bonds or bonds of State Enterprises.

- an investment in a property mutual fund or a mutual fund for resolving financial institution problems established under the law on Securities and Stock Exchange.

- an investment in share capital of a juristic person who is granted permission of investment under the law on investment promotion.

power to dispose such land. An exception of this requirement may be granted to foreign-owned companies on a case-by-case basis according to Sec. 97 Land Code.

In the case of an inheritance of land by foreigners (applies only to the statutory heir under Sec.1629 CCC, such as a spouse or the foreign child of a Thai-foreign marriage), the consent of the Minister of the Interior is also necessary.[1] Even with inheritance, the heir is limited in terms of the maximum plot size. The limit depends on the use of land and is up to 1 Rai (1,600 square meters) for residential purposes, or 10 Rai (16,000 square meters) for agricultural or industrial use.

If, after the inheritance, the heir owns more land than is permitted by the Land Code for foreigners, he/she is obliged to sell the surplus within a period of time (six months to one year). Otherwise, it will be forcibly sold by the state.[2]

b) Ownership through Marriage

It is not recommended to try to acquire real estate through marriage with a Thai citizen.

Thai law provides for joint property between spouses.[3] If a piece of land is acquired after marriage, co-ownership of the foreign spouse would be the result of this law, which would be incompatible with the Land Code.

Consequence: In the case of acquisition before marriage, the Thai spouse may retain ownership of the property if he/she retains the Thai citizenship, but the foreign spouse acquires no joint ownership. In the case of a purchase after the marriage, the acquisition of the land is fundamentally void right from the start. However, there are exceptions that do not lead to an automatic nullity of the acquisition (see below).

Therefore, such a procedure can only be discouraged, since even with registration of the spouse as the owner, there is no security. Under Thai law, such transactions are in principle null and void. The relevant property must be sold immediately, otherwise it is forcibly sold by the responsible director of the Land Department. The Land stipulates:

“Any real estate which a foreigner has obtained illegally or without permission must be sold by the latter within the period of time set by the Director-General which is between 180 days and one year. If the property has not been sold within this period, the Director-General has the right to dispose of it independently.”

[1] Sec. 93 Land Code.

[2] Sec. 94 Land Code.

[3] Sec. 1465 ff. Civil and Commercial Code (“CCC”).

c) Separation of Property

For Thai spouses who want to acquire property after a marriage, there is always the possibility that a separation of property between the foreign and the Thai spouse is agreed upon. However, this separation of property agreement only applies if it has already been concluded before marriage.[1] It must be in writing with the attestation of two witnesses and entered into the marriage register. Registration is essential as proof.

It is legally problematic to arrange the separation of property abroad. Although the conclusion of a marriage contract abroad is possible in principle, governing law for real estate matters is always the law of the country in which the property is situated.

The separation of property has the consequence that only the Thai spouse acquires ownership of the property. The following consequences have to be considered:

- Death of the Thai spouse: The foreigner has limited rights to acquire land ownership.

- Divorce: The foreigner has no right to acquire land ownership.

It is also not possible for foreigners to register a mortgage to secure the funds made available by the foreign spouse in order to acquire the property.

If spouses are used as nominees for land acquisition – i.e. a (Thai) person acquires land on behalf of a foreigner – this land can be sold by the responsible director of the Land Department. The law stipulates:

“If it turns out that a person has acquired land ownership on behalf of a foreigner in the sense of Sec. 97 and 98, the Director-General shall have the right to sell the land.” [2]

Thus, the Land Department would have to be convinced for each individual case that the acquisition of land by the Thai spouse was not intended to circumvent the ban on land acquisition by foreigners. In practice, therefore, a principally legal acquisition may fail due to the interpretation of the authority.

d) Ownership under Notification of the Ministry of Interior no. Mor.Thor.0710/Vor.792 dated 23 March 1999, and Notification of the

[1] Sec. 1465 CCC.

[2] Sec. 96 Land Code.

Ministry of the Land Department no. Mor. Thor. 0710/Vor. 00795 dated 11 January 2000

A certain simplification of land acquisition, at least for the Thai spouse, was introduced by the Notifications no.Mor.Thor.0710/Vor.792 and Mor.Thor. 0710/Vor.792. According to notifications, the Thai spouse may acquire land, provided that the foreign spouse confirms that the origin of the funds for the land originated exclusively from the property of the Thai spouse and already existed before the marriage.

The consequence of the declaration is that in the case of a divorce, the property falls solely to the Thai spouse. Legally, it is a matter of so-called personal (non-marital) assets.[1] This property does not become joint property of both spouses and falls back to the Thai partner after the divorce.[2]

Likewise, after divorce or separation, a Thai citizen may acquire land or be gifted by the foreign ex-spouse. However, the divorce or separation should not be seen as a circumvention of the above principles, otherwise the land can be forcibly sold according to the Land Code.

This practically simplifies the acquisition of land for the Thai spouse. A separation of property is no longer necessary to prevent the nullity of co-ownership in case of joint marital property. In addition, the fear that land acquisition will be considered as attempt to circumvent the restrictions of the Land Code is eliminated.

On the other hand, the foreign spouse still has no security with regard to an investment. On the contrary, it remains very risky. An independent land acquisition by the foreigner is still not possible.

e) Registration of Right of Residence

It is possible to register a lifelong right of residence. By doing so, the Thai spouse, as the owner of the property, grants the foreign spouse the right to use the property.[3] The right of residence remains in the case of divorce and can be transferred to an heir.[4] This right of residence is not a violation of the strict rules of the Land Code, as the property remains in Thai ownership. In practice, the right of residence has the consequence that the property is difficult to sell.

[1] Sec. 1471 CCC.

[2] Sec. 1533, 1534 CCC.

[3] Sec. 1410 CCC.

[4] Sec. 1411, 1412 CCC.

1.2 Ownership of Buildings

It is much easier for a foreigner to acquire ownership of buildings in Thailand. Under Thai law, the unity between land ownership and building ownership is not mandatory; land ownership and building ownership can fall apart. Therefore, it is possible that a foreigner rents an undeveloped land for a period of initially 30 years (with the possibility of extending this lease for another 30 years) and then builds a house on this land. However, it should be noted that leases for a period of more than 3 years must be registered with the Land Department. Otherwise, the landlord is free to re-let the property after 3 years.

It should also be noted that ownership of the building constructed on another person’s land is not recorded in the title deed of the land. Rather, ownership of the building is evidenced, for example, by the construction permit. If the landowner sells the land, the new landowner may demand the demolition of the building from the building owner (against payment of compensation). For this reason, we recommend that additional security be registered when purchasing a building. Also, clauses should be inserted into the contract which impose on the lessor the obligation to ensure that the new owner also grants the tenant the extension option.

2. Ownership by Companies

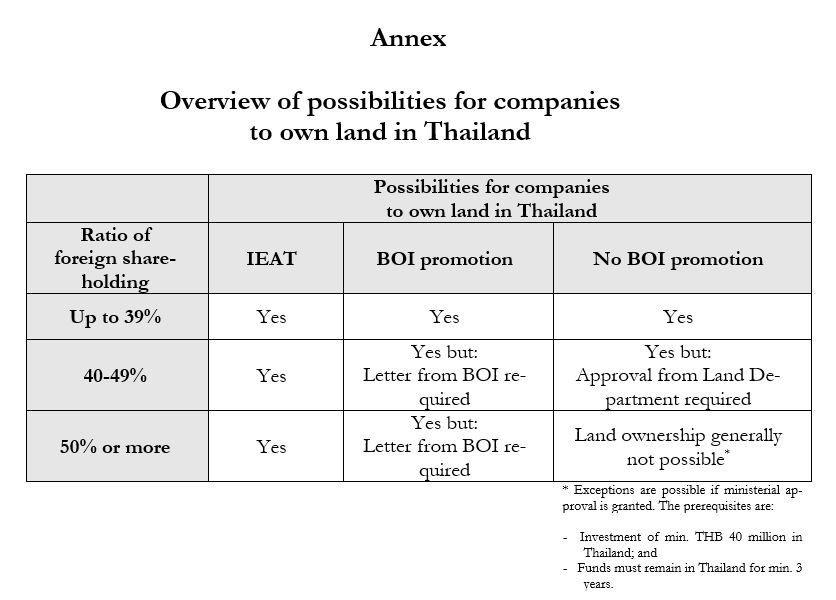

In principle, foreign companies are prohibited to own land in Thailand. Foreign companies are those in which more than 49% of the shares are not held by Thais.[1] Only exceptionally, foreign companies are allowed to own land.

2.1 Land Acquisition outside of Industrial Zones

According to the regulations of the Land Code, the same restrictions apply to foreign companies as to foreign natural persons. For example, a company whose capital is held more than 49% by foreigners, or where more than half of its shareholders are foreigners, can only acquire land ownership if:

- this has been approved by the Minister of the Interior;[2] or

[1] Sec. 97, 98 Land Code; According to Sec. 13 Foreign Business Act, regulations in other laws regarding the amount of foreign shareholding in companies supersede the regulation of Sec. 4 Foreign Business Act. This is important because the regulations in Sec. 97 Land Code and Sec. 4 Foreign Business Act are not identical in content.

[2] Sec. 86 Land Code.

- at least THB 40 million is invested in Thailand, this investment is beneficial to the Thai economy and the invested capital remains in Thailand for at least five[1]

It should be noted that special rules apply if the foreign shareholding in the company is between 40 and 49%. The restrictions of the Land Code are not applicable since the foreign shareholding is less than 49%. However, in this case, a permission of the Land Department (if the property is located in Bangkok) or of the respective Provincial Governor (if the property is located in another province) is required.[2] If the foreign shareholding is less than 40%, the company may in principle acquire land without restrictions (see Annex).

In practice, it often happens that for the purpose of acquiring land, a company is initially set up with a foreign shareholding of less than 40%, and thereafter the foreign shareholding is increased. Caution is advised because the restrictions on the acquisition of real estate also apply to companies that only become foreign companies in the relevant sense after completion of the acquisition of ownership.[3]

The attempt to set up a company with a majority of (nominee) Thai shareholders to acquire land without restrictions is not recommended. The Thai authorities are well aware of this business practice. The regulation Mor. Tor. 0515 / Vor 1562 expressly refers to the review process and requires detailed research by the Thai authorities of the actual company shareholdings. Thai investors have to prove their ability to finance the purchase of company shares. This applies unconditionally as soon as foreigners are involved as shareholders or as managing directors in a company acquiring land. In addition, any circumstances that lead to the assumption that the land acquisition is on behalf of foreigners are sufficient for initiating more detailed investigations. In these cases, the officer of the Land Department is instructed to investigate the origin of the Thai shareholders’ funds to purchase their shares. In particular, the profession and income of the Thai shareholders will be taken into account.

In the recent past, the Thai authorities have already rejected applications made on the basis of this regulation. It therefore requires very careful, well-structured planning in order to acquire land over through a company.

[1] Sec 96 bis Land Code.

[2] Clause 4 of the Notice of Department of Lands, issued on 26 April 2001, published in Government Gazette Vol. General: 118, Special part 44 Ngor. dated 18 May 2001.

[3] Sec. 100 Land Code.

2.2 Land Acquisition in Industrial Zones

Foreign-owned companies have the option of acquiring land in certain industrial zones.

To promote de-concentration away from Bangkok and to attract investment in structurally-weak areas, the government has founded the Industrial Estate Authority of Thailand (IEAT) in the early 1970s. The IEAT planned and developed special industrial zones throughout Thailand, which are fully developed and provided with a nearly perfect infrastructure. In addition to numerous other privileges and benefits, especially with regard to taxation, foreign companies can acquire full ownership of land in these industrial zones.

A foreign-owned industrial company (manufacturer or trader) may acquire land in an Industrial Estate

- for carrying out a business activity in accordance with Sec. 44 of the Industrial Estate Authority of Thailand (IEAT) Act; and

- in a size as deemed appropriate by the IEAT.

If the foreign-owned industrial operator ceases its business or assigns it to another person, the land must be disposed within 3 years. If the foreign operator does not comply with the said requirement, the land will be sold by the Director-General of the Land Department in accordance with the Land Code.

2.3 Land Acquisition through BOI Promotion

Many companies have the opportunity to receive investment promotion from the Board of Investment (BOI). The conditions for such promotion are regulated in the Investment Promotion Act. Companies that have been granted a so-called Promotion Certificate by the BOI are allowed to acquire land.[1] However, special rules apply if the foreign participation in the company exceeds 40%. In this case, a written approval of the BOI is required,[2] but it is regularly granted. In the case of approval by the BOI, there will be no further investigation by the Land Department.

BOI promotion is especially granted if the type of business appears to be valuable for the development of the Thai economy.

[1] Sec. 27 Investment Promotion Act.

[2] Clause 3 of the Notice of Department of Lands, issued on 26 April 2001, published in Government Gazette Vol. General: 118, Special part 44 Ngor. dated 18 May 2001.

In case the promoted foreigner dissolves its BOI promotion or transfers it, the foreigner must dispose the land within 1 year of the date of the BOI dissolution or transfer.[1]

III. Formalities

1. Land Purchase

1.1 Purchase Agreement

Land purchase agreements are drafted by lawyers; notarization is (unlike in other countries) not required.

1.2 Land Documentation

Until the 1970s, land was reclaimed in Thailand through deforestation. This was done in private initiative by the rural population in remote areas, which were not yet under sufficient state control. The land census therefore posed a double task for the governmental authority, namely identifying the existing land and assigning it to individuals. This results in a large variety of land documents until today.

a) Title Deed („chanote“, Form Nor Sor 4)

The land seller’s ownership ideally proven by a title deed (Nor Sor 4). These title deeds are issued by the respective Land Department. However, until today title deeds have not yet been issued for all land in Thailand. For some land there are only replacement documents, which prove the right of possession, but not the ownership of the land.

b) Certificate of Land Utilization (Forms Nor Sor 3 and Nor Sor 3 Gor)

The most common land document is the Certificate of Land Utilization, which is available as a confirmed version (Nor Sor 3 Gor) or as a simple copy (Nor Sor 3). The latter has less content, for example no aerial photograph.

This Certificate of Land Utilization in connection with a map indicating the location of the land was often sufficient to prove a seller’s legitimacy. It should be noted, however, that in many areas, notably Bangkok or other metropolitan areas, these replacement documents have since been replaced by title deeds. In some areas, the proportion of land on which a title deed is issued has already risen to

[1] Sec. 27 Investment Promotion Act.

80-90%. If the seller of land in such areas cannot present a title deed, caution is advised. It is advisable either to ask the seller to obtain a title deed or to have a Thai lawyer make inquiries at the land department.

Under the law, this document confirms only the right to possess and use the land as an individual owner, but not the full ownership as the title deed owner. The holders of Nor Sor 3 land can lose their rights of possession after being interrupted by another person for 1 year (while the ownership of the title deed can be transferred to another person who peacefully and openly possessed the land for an uninterrupted period of 10 years).

c) Pre-emption Certificate („bai chong“, Form Nor Sor 2)

This document authorizes the temporary possession of the designated land. It is not suitable for the proof of an owner-like position.

The holder is obligated to commence the utilization on the Nor Sor 2 land within 6 months and has to complete the utilization on the land within 3 years from the receipt of Nor Sor 2 land. This type of land may not be sold or transferred except for inheritance. After the completion of the determined utilization, the holder can upgrade the certificate to a certificate of land utilization (Nor Sor 3) or a title deed.

d) Land Particulars Certificate („bai tai suan“, Form Nor Sor 5)

This document proves the absolute possession of land, which is first measured in the course of the application for such document and provided with boundary marks. The issuance of the Land Particulars Certificate precedes the issuance of a title deed. Therefore, it is necessary that no other person has rights to such land.

e) Plot Identification Slip („bai name“)

This document is required to apply for a Land Particulars Certificate.

f) Squatter Certificate („bai yieb yum“) and Certificate of Possession (Form Sor Kor 1)

These documents are required to apply for a Certificate of Land Utilization.

1.3. Registration

The registration of the land ownership transfer is carried out by the Land Department. To this end, buyers and sellers must appear either in person or by a representative before the competent Land Department and prove the purchase, inter alia, with a valid written purchase contract. The following registration fees apply:

- Transfer fee: 2% of the assessed value (as determined by the Capital Assessed Price Fixing Committee)

- Stamp duty: 0.5% of the purchase price or the assessed value, whichever is higher

- The registration of a mortgage is subject to an additional registration fee of 1% of the secured amount.

Taxes on the sale of land are described in Chapter 5.

1.4 Land Purchase in Industrial Zones

The prospective buyer must submit a request for land use permission with the Industrial Estate Authority of Thailand (IEAT). After approval by the authority, the purchase contract can be signed with the seller. Furthermore, the buyer must conclude a contract with the IEAT on the land use, which must comply with the generally permissible use for the entire industrial zone.

2. Condominium Purchase

2.1 Basics

The easiest and safest way for foreigners to acquire property is the purchase of condominiums. This is permitted to natural and juristic persons under the New Thailand Condominium Act 2008. However, the total share of foreign-owned units per building may not exceed 49%.[1]

If one of the following criteria is fulfilled, foreigners can in principle acquire condominiums under the Condominium Act:[2]

- The foreigner holds a Residence Permit.

- The foreigner has obtained BOI promotion.

- The foreigner remits the purchase price in foreign currency into Thailand from abroad.

2.2 Proof of Ownership

[1] Sec. 19/2 bis Condominium Act.

[2] Sec. 19 Condominium Act.

Proof of ownership for condominiums is comparable to the proof of ownership of land. Normally, a unit title deed or a unit certificate of ownership is issued for the individual residential unit. This document contains the name and first name of the owner, the location and size of the land plot as well as the location and size of the residential unit. In addition, it must contain the share of the ownership of the common property. It should be noted that foreigners do not receive ownership of the common ground.

2.3 Transfer of Ownership

The registration of the condominium ownership transfer is carried out by the Land Department. The process is as follows:

- The application and all necessary documents for the registration of the transfer of the unit title deed are being completed together with the responsible official of the Land Department.

- A prepared official sales contract is signed in the presence of the official.

- If a mortgage shall be registered, these documents will also be prepared by the Land Department and must be signed in the presence of the official.

The following fees apply to the owner:

- Transfer fee: 2% of the assessed value

- Stamp duty: 0.5% of the purchase price or the assessed value, whichever is higher (unless the seller is subject to specific business tax, see below)

- The registration of a mortgage is subject to an additional registration fee of 1% of the secured amount.

2.4 Inheritance of condominium by foreigners

Under Sec. 19 of the Condominium Act, a foreigner can acquire a condominium unit via inheritance (either as a statutory heir or inheritor under a will) as long as the volume of the unit does not cause foreign ownership in the condominium to exceed the 49% quota. In case the ownership exceeds the 49% limit, the foreigner must dispose it within 1 year from the acquiring date.

IV. Rental for Residential and Business Purposes

In general, when renting land, it should be ensured that the landlord is actually the owner of the land.

1. Rental for Commercial and Industrial Purposes

The rental of land for commercial and industrial purposes is regulated by the Act Governing Leasing of Immovable Property for Commercial and Industrial Purposes B.E. 2542 (1999).

For these purposes, it is possible to conclude a rental agreement for a total of two times 50 years. Such agreements must be concluded in writing and registered with the Land Department. The type of use must also be registered. If the rented land is greater than 100 Rai (16 hectares), an approval of the Director-General of the Land Department is required.

In addition to the long-term planning security, the registered long-term lease has the advantage that the rental right can be used as collateral like a mortgage.

The rental right can also be inherited and transferred, unless this is in contradiction to the lease. Furthermore, subletting is possible, but requires prior registration with the responsible Land Department. When the rental property is sold to a third party, the acquirer enters into the rights and obligations of the lessor, so that the rental agreement is retained (purchase does not break rent).

2. Rental for Residential Purposes

A rental agreement of land for private purposes may not exceed a rental period of 30 years, whereas a 30-year extension can be agreed twice.[1]

Only a written rental agreement for privately used land is legally enforceable.[2] Contracts with a rental period of more than three years are to be registered with the Land Department, otherwise they are unenforceable.[3]

A transfer of the rental right or a sublease is not possible for privately used land, unless the rental agreement provides otherwise.

3. Other Legal Constructs

3.1 Arsai[4]

The legal institution “Arsai” regulates the free use of a house or in general a land area for residential purposes. The person tolerated by Arsai, however, is granted only a relatively weak legal position. The right of residence can be terminated at

[1] Sec. 540 CCC.

[2] Sec. 538 CCC.

[3] Sec. 538 sentence 2 CCC.

[4] Sec. 1402 ff. CCC.

any time by the owner if no time has been determined. Also, the right is neither transferable nor hereditary. The owner does not have to keep the house in an adequate condition; the beneficiary cannot demand compensation for expenses incurred by him. The Arsai legal institute can be established both for the lifetime of the beneficiary and for a maximum period of 30 years.

3.2 Usufruct[1]

“Usufruct” grants the beneficiary the possession and use of the encumbered land, and in the case of forests, mines and quarries, the produce. The beneficiary bears the burden of the property for the period of usufruct. This right may be established for the beneficiary’s lifetime or for a maximum of 30 years. In contrast to superficies, usufruct is basically neither transferable nor inheritable.

3.3 Superficies[2]

Under “Superficies”, the claimant becomes the owner of the building he builds during the contract period. In addition, he has the right to use the land for residential purposes.[3] Subsequently, he either has to dismantle the erected building or sell it to the land owner at market value. If a contract duration is not stipulated, the contract can be canceled at any time by both parties. Superficies can be established for the lifetime of the beneficiary or the owner of the land or for a maximum of 30 years. It is basically transferable and hereditary.

3.4 Sub-Ing-Sitthi[4]

Sub-Ing-Sitthi is similar to lease, but poses less limitation and grants more flexibility. Assets which can be registered for Sub-Ing-Sitthi are land with title deed (with/without buildings) and condominiums. The registration of Sub-Ing-Sitthi must be made in writing and registered with the land department (30 years maximum). The grantee of Sub-Ing-Sitthi can lease out, sell, transfer, inherit, use as collateral (mortgage), alter, modify and construct any building on such asset, without permission/consent of the grantor needed. It is basically transferable and hereditary.

V. Taxes related to the Purchase of Real Estate

[1] Sec. 1417 ff. CCC.

[2] Sec. 1410 ff. CCC.

[3] Supreme Court Decision Case No. 3702/2535 (1992).

[4] Act on Sub-Ing-Sitthi B.E. 2562 (2019), effective since 27 October 2019.

In principle, every owner is free to resell the land or condominium at any time. It should be noted that there are different tax regulations for natural and juristic persons.

1. Specific Business Tax

Commercial land sale[1] is subject to a specific business tax of 3% of the assessed land value or the actual purchase price, whichever is higher.[2]

Non-commercial land sale is only subject to the specific business tax if it occurs within five years of the land acquisition,[3] except in the case of expropriation, inheritances and transfers to government organizations.

2. Local Tax

The local tax is a supplementary tax to the specific business tax and is levied at a rate of 10% of the tax amount from the specific business tax.

3. Government Transfer Fee

The transfer fee is 2% of the assessed value. From 3 February to 31 December 2021, the property transfer fee is reduced from 2% to 0.01% and the registration of mortgage fee is decreased from 1% to 0.01% in accordance with the Notification of the Ministry of Interior. The new rate only applies to a land with building(s) or a condominium, priced under THB 3 million and bought from real-estate developers.

4. Stamp Duty

Stamp duty may be levied at 0.5% of the assessed value or the actual purchase price, whichever is higher.[4] It should be noted, however, that the stamp duty only applies if the land sale is not subject to specific business tax.[5]

5. Withholding Tax

[1] As defined in Royal Decree No. 342 (1998).

[2] Sec. 91/6 (3) and Sec. 91/5 (6), Sec. 91/2 (6) Revenue Code.

[3] Royal Decree No. 342.

[4] Item 28 (b)(c) of the Stamp Duty Schedule attached to the Revenue Code.

[5] R.C.C. A.A. (No. 30) B.E. 2534 S.13.

If a juristic person sells a property, the assessed value will be subject to 1% withholding tax.[1] The tax is withheld by the buyer and paid to the Revenue Department (taxation at the source). The seller receives a withholding tax certificate and can credit the withholding tax against its corporate income tax.

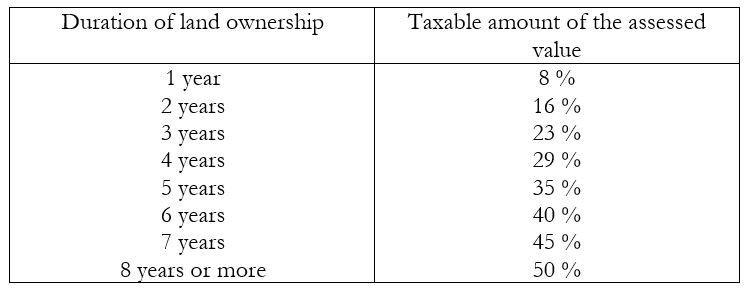

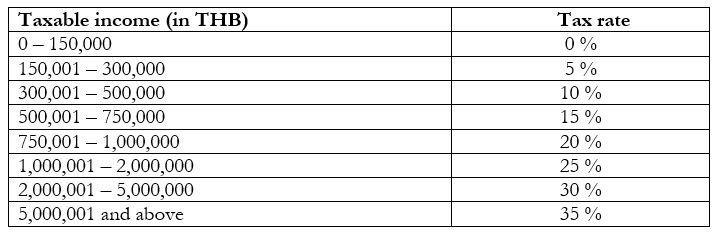

Commercial land sale by individuals is subject to income tax. The tax base is calculated according to the assessed value, even if it is lower than the actual purchase price.[2] The taxable amount is based on the length of ownership of the sold land:

The resulting amount is divided by the number of years of ownership.

The quotient is taxed according to the general progressive tax rates:

The result is multiplied by the number of years of ownership. The product corresponds to the tax to be paid by the seller.[1]

If the land sold was obtained through inheritance or other non-commercial legal transactions, only 50% of the estimated value is taxed.[2]

[1] Sec. 48 (4) (b) Revenue Code.

[2] Sec. 48 (4) (a) Revenue Code.

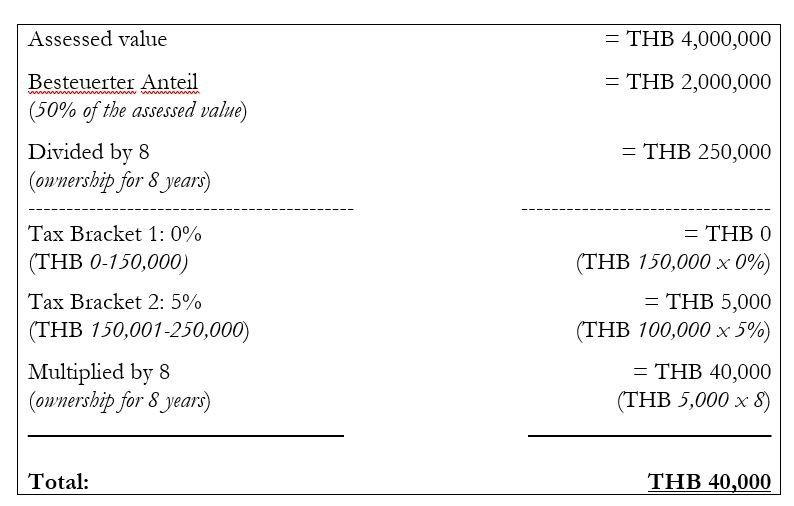

Example 1:

A land bought 8 years ago is being sold for THB 6,000,000 and has an assessed value of THB 4,000,000.

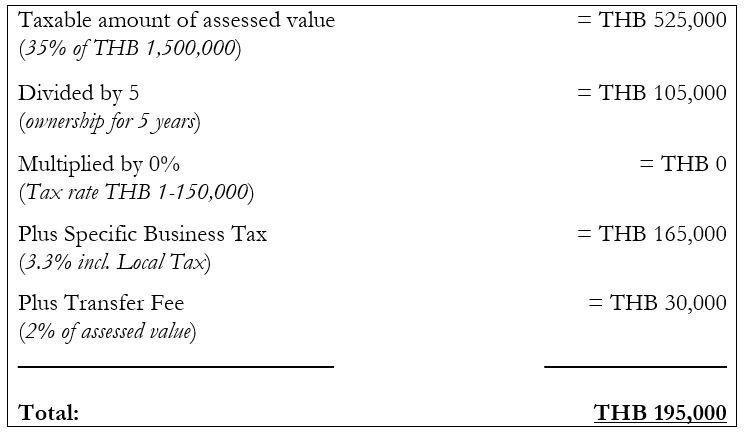

Example 2:

A two-rai plot of land purchased by a private individual for THB 2,000,000 in 2014 will be sold for THB 5,000,000 in 2019. The assessed value is THB 750,000 per Rai, totaling THB 1,500,000.

- Specific business tax (including local tax) applies even if it is not a commercial sale, as the sale took place within five years after the acquisition of the property (3.3% (including local tax) of the purchase price of THB 5,000,000).

= THB 165,000

- Stamp duty is 0.5% of the selling price, but in this case does not apply, as the seller has to pay specific business tax.

= THB 0

- The transfer fee is 2% of the assessed value (2% of THB 1,500,000).

= THB 30,000

- Personal income tax: 0%

- Calculation:

VI. Annual Taxes for Land Owners

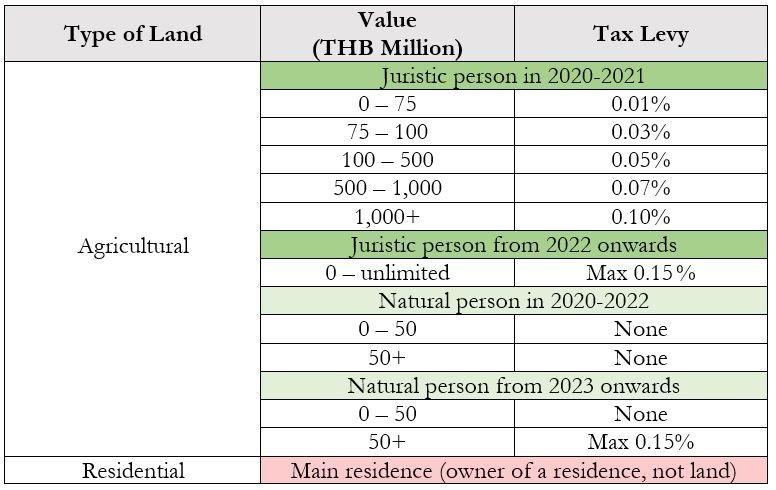

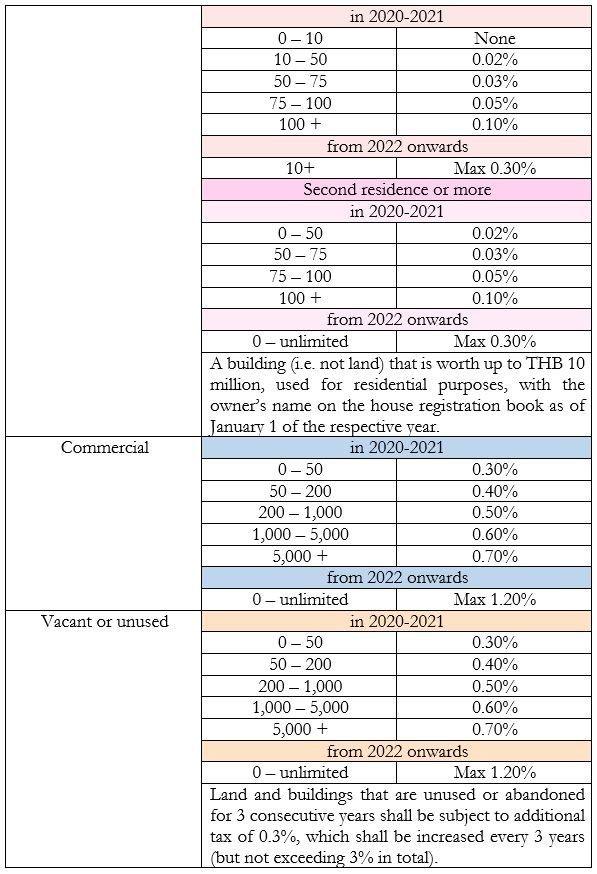

According to the Land and Building Tax Act B.E. 2562 (2019), land and buildings shall be taxed at the following rates:

The Royal Decree on Land and Buildings Tax reduction (No. 2) B.E. 2564 further reduces the Land and Buildings Tax payments by 90% (pay only 10%), for the year 2021, for the following types of land and buildings:

- Land or buildings used for agricultural purposes;

- Land or buildings used for residential purposes;

- Land or buildings used for other purposes; and

- Vacant or unused land or buildings.

For example, the owner of the unused land which is worth THB 10 million bears the tax burden 0.3% or THB 30,000. Under the Royal Decree, he/she is granted the reduction of 90%. Thus, he/she must pay the tax THB 3,000 in the tax year 2021.

Although Lorenz & Partners Co., Ltd. always pays greatest attention on updating the information provided in this newsletter we cannot take responsibility for the topicality, completeness or quality of the information provided. None of the information contained in this newsletter is meant to replace a personal consultation. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is in-complete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.

We hope that this information brochure can be of any help to you.

Please do not hesitate to contact us in case you have further questions.

LORENZ & PARTNERS Co., Ltd.

27th Floor Bangkok City Tower

179 South Sathorn Road, Bangkok 10120, Thailand

Tel.: +66 (0) 2-287 1882

Email: [email protected]

www.lorenz-partners.com