I. Introduction

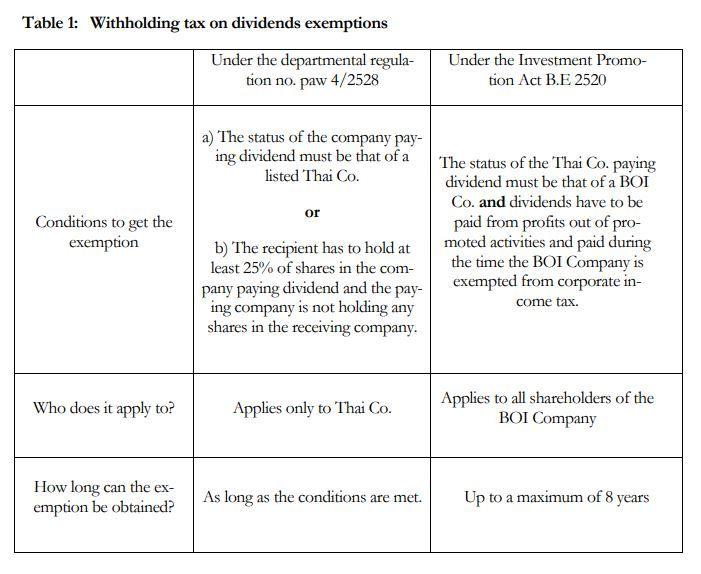

Whenever a Thai Company pays dividend to its shareholders, such dividend is normally subject to income tax at the rate of 10%. However, there are the following five exemptions which shall be discussed in this newsletter:

Ø Clause 5 of the Department Regulation No. Paw 4/2528

Ø Section 34 of the Investment Promotion Act B.E 2520 (BOI)

Ø Section 8 of Royal Decree No. 674 (IBC)

II. Clause 5 of the Department Regulation No. Paw 4/2528

1. Requirements

Clause 5 of the Department Regulation No. Paw 4/2528 has actually two exemptions:

a) The Thai Company pays dividend to a Listed Company. A Listed Company is a Company that is registered at the Thai stock market.

b) A non-listed Thai Company, receiving dividend from another Thai company, holds at least 25% of the total shares (with voting rights) of such company, and the paying Company is not holding any shares in the receiving company (no cross-shareholding).

2. Comment

In order to additionally save corporate income tax, the non-listed Thai Company receiving dividend needs to hold the shares in the paying company for at least 6 months. (3 months before the dividend is paid and additional 3 months after the dividend is paid).

III. Section 34 of the Investment Promotion Act B.E. 2520 (BOI)

1. Requirements

The Thai Company paying dividend has to be a company promoted by the Board of Investment (BOI). Additionally, it is required that the dividend is paid from profits out of promoted activities and that such dividend is paid during the time the BOI Company still is exempted from corporate income tax. Such exemption is granted for up to eight years, starting with the date the BOI Company starts operating.

2. Comment

a) In fact, BOI Companies sometimes get profit out of promoted and non-promoted activities. In such case, profits have to be separated into earnings resulting from promoted activities and ones resulting from non-promoted activities. The BOI Company can choose to pay dividend from its profits either arising from promoted or non-promoted activities. However, only dividends paid from promoted activity go along with the tax exemption.

b) This exemption applies to all shareholders of the BOI Company, local and foreign.

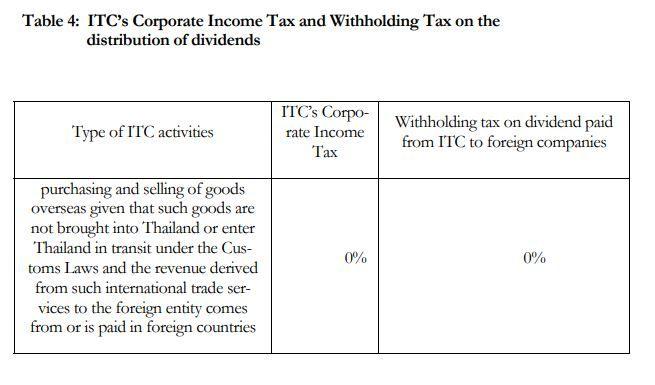

IV. Section 8 of Royal Decree No. 674 (IBC)

1. Requirements

International Business Centers are defined as companies that are established under Thai laws which have a minimum paid-up capital of THB 10 million, minimum annual expenses in Thailand of THB 60 million and carry out businesses in general management, business planning and business cooperation; procurement of raw materials and parts; research and development of products; technical support; marketing and sales promotion; human resources management and training; financial advisory services; economic and investment analysis and research; credit management and control; financial management service of the treasury centre; international trade business; lending to associated enterprises to its affiliates or branches located in Thailand or aboard (for details, please refer to our Newsletter No. 219).

The Foreign Company receiving dividend must be a shareholder of the IBC Company and must not carry on business in Thailand. Further on, the dividend has to be paid out from the IBC’s net profits from such income that is granted CIT reduction.

2. Comment

a) This exception only applies to foreign companies. It does not apply to individuals or Thai companies.

b) This exemption is granted for up to 15 years.