- 29 January 2020:

- The Ministry of Industry will inspect 6,104 plants nationwide which can cause PM2.5, particularly the factories using boilers and other combustion equipment (e.g. dyeing, lumbering, manufacturing of garment, textile, and chemical product), in order to fight PM2.5 problem.

- The government will closely monitor the price and quantity of hygienic masks, instruct sellers to clearly show the price and not to unreasonably increase the price. In case of hoarding and unfair price increasing, the seller will be deemed to violate the Act on Prices of Goods and Services (imprisonment not exceeding 7 years, fines not exceeding THB 140,000, or both). Consumers can lodge a complaint via hotline 1569 or contact the Office of Provincial Commercial Affair directly.

- The Office of Industrial Economics believes that the coronavirus outbreak will bring a positive impact to Thailand in the long run, seeing that foreign entrepreneurs will relocate their production bases to Thailand in some industries.

- 2 February 2020:

- The Office of Industrial Economics predicted that export value of Thailand (in US dollar) will expand 2.74% in 2020 and the GSP cutoff by the US, taking effect on 25 April 2020, may affect local exporters who rely on this benefit, but there will not be high impact overall. He also cited that certain Thai products to lose GSP is only 0.5% of total exports of the country. Moreover, investment will expand 3.9% in private sector and 5.07% in public sector.

- 2 February 2020:

- The Federation of Thai Industries, together with the Pollution Control Department and Thai Industrial Standards Institute, launched a new campaign in cooperation with car maintenance service centers, oil and gas companies, and automotive companies, to reduce PM2.5 by offering vehicle inspection free of charge, 50% discount for engine oil changing, and discount for replacement parts (price and discount may vary upon conditions of each service provider).

New Cabinet resolutions

4 February 2020:

- Approved Principle: Draft Royal Decree issued under the Revenue Code re: tax exemption (No. …) B.E. …. (tax measures to support employment of ex-convicts)

- A company or juristic partnership who employs an ex-convict can enjoy this tax benefit to reduce Corporate Income Tax

- Allowing to deduct 50% of actual expenses spent on employment of an ex-convicts (maximum THB 15,000/person/month)

- For accounting period begins on/after 1 January 2020 but not later than 31 December 2020

- Approved: Tax measures to reduce economic impact of business tourism in 2020

- 3-month extension of deadlines for submitting Personal Income Tax forms (Por.Ngor.Dor.90 and Por.Ngor.Dor.91)

– New deadline: within June 2020.

- Support company and juristic partnership to hold a seminar for employees within the country by

– Allowing to deduct 2 times of actual expenses spent

– Duration: spending between 1 January 2020 – 31 December 2020

3. Support company and juristic partnership, operating a business under the hotel laws, to renovate, change, expand, or improve properties in relation to the business, excluding fixing them to the previous state, provided that the properties added shall be as follows:

3.1 Permanent building built for operation of hotel business under the hotel laws; and

3.2 Decoration or furniture permanently equipped and attached to the said building.

– Allowing to deduct 1.5 times of actual expenses

– Duration: spending between 1 January 2020 – 31 December 2020

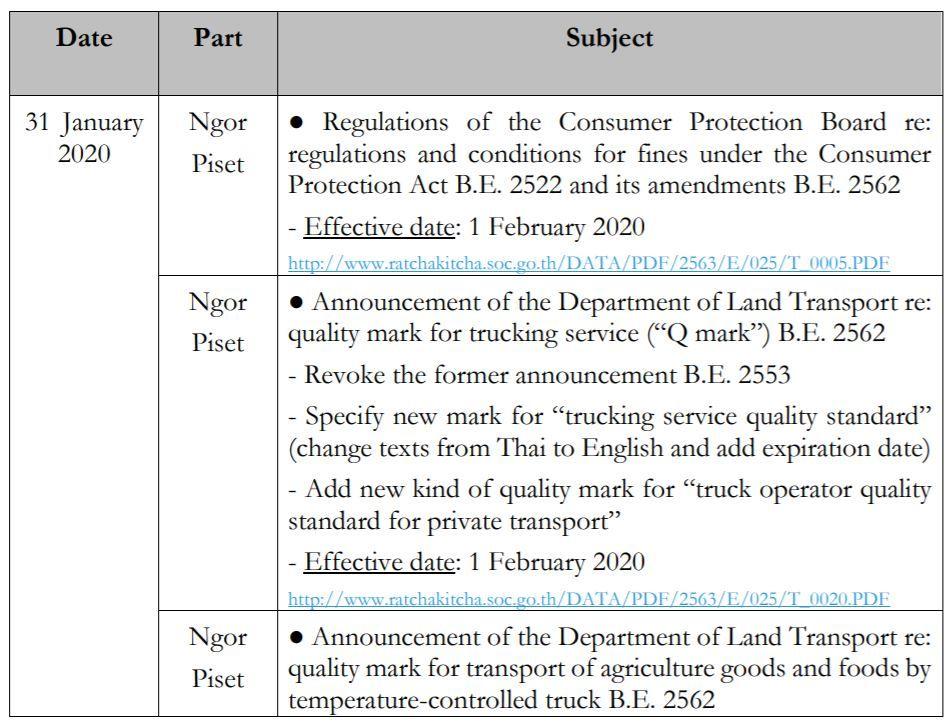

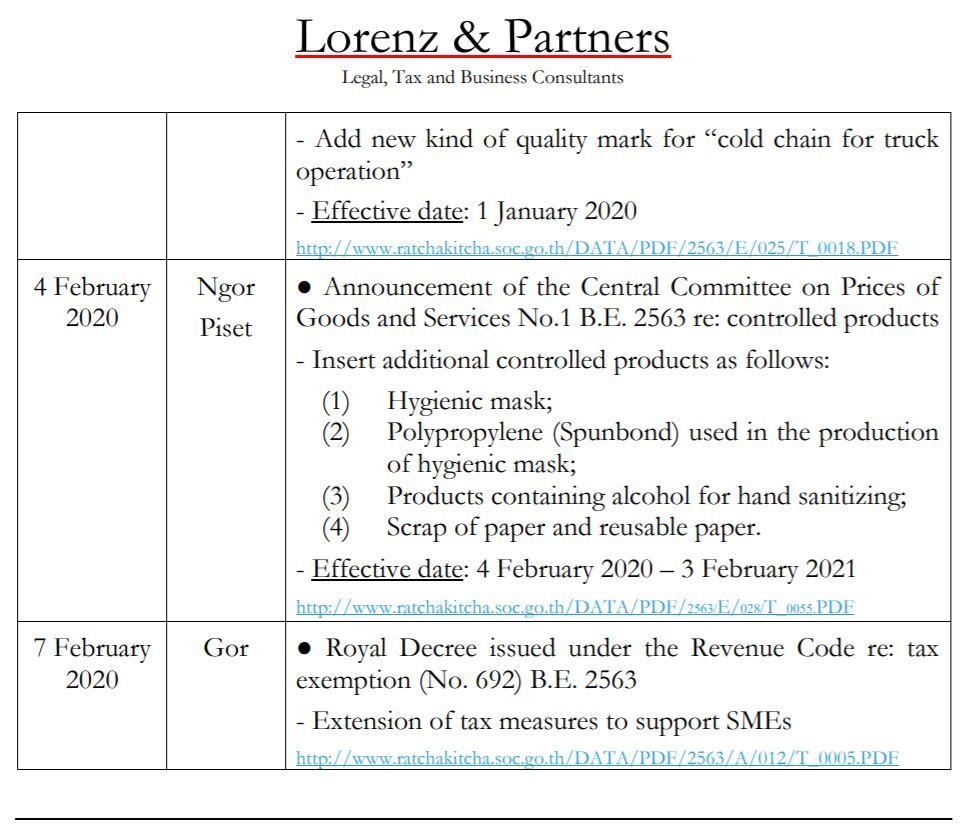

Royal Gazette Update: