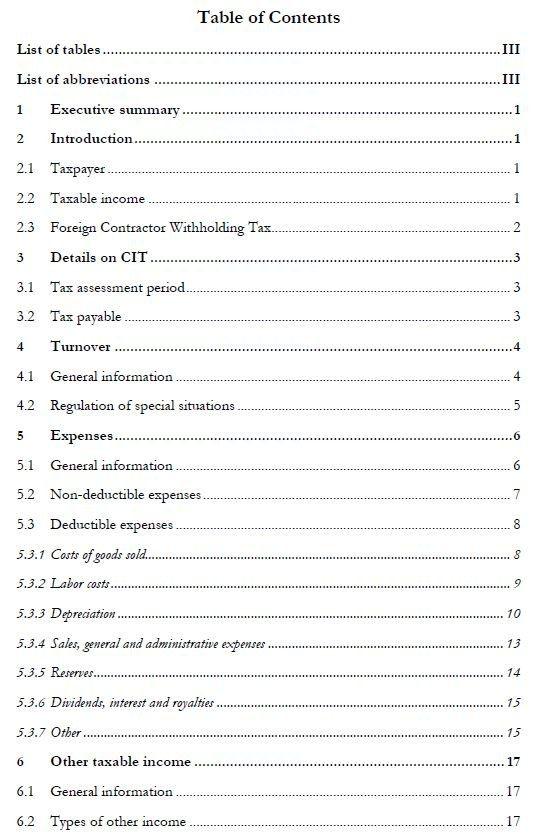

1 Executive summary

The Corporate Income Tax (CIT) is applied with the general rate of 20% on the profit1. A variety of tax reductions and –exemptions is applied depending on the type and region of the investment.

The CIT is applied on companies registered in Vietnam and on foreign companies doing business in Vietnam. Doing business in this sense includes providing any kind of service which is consumed within Vietnam.

2 Introduction

2.1 Taxpayer

Taxpayer of CIT especially is:

➢ an enterprise established in Vietnam and

➢ an enterprise established outside Vietnam with or without a Permanent Establishment (PE) in Vietnam.

The ownership structure of the entity is not relevant for the applicable tax rate. Foreign Invested Companies (FIC)2 are taxed in the same way as Vietnamese invested companies.

But a FIC must have the annual financial statement audited3 and under certain conditions must provide consolidated financial statements.

2.2 Tax able income

Taxable income is the income from production, trading and services and other income. Other income is especially the income from capital transfers, transfer of real estate or investment projects, from the ownership of rights, loans.

Companies registered in Vietnam are taxable with their world-wide income.

_______________________

1 Law on Corporate Income Tax No. 14/2008/QH12 dated 03 June 2008, amended by Law No. 32/2013/QH13 dated 19 June 2013 and Law No. 71/2014/QH13 dated 26 November 2014 If mentioning in this Brochure Articles without naming a regulation, the “Law on CIT” is meant.

2 A FIC means a company registered in Vietnam with a foreign individual or organization being a member or shareholder under Article 3, No. 22, Law on Investment 61/2020/QH14.

3 Article 15, No.1, Decree 17/2012/NĐ-CP

Companies registered outside Vietnam are taxable in Vietnam with the income:

➢ Without having a PE in Vietnam: on income arising in Vietnam.

➢ With having a PE:

o on income arising in Vietnam and on income arising outside Vietnam which relating to the operation of the PE;

o on income arising in Vietnam not relating to the PE;

Example: The German company A having a PE in Vietnam earns income of:

a. 10 Mio EUR in Germany which is not related to the PE in Vietnam;

b. 5 Mio EUR in Vietnam which is related to the PE;

c. 5 Mio EUR in Cambodia which is related to operations of the PE;

d. 5 Mio EUR in Vietnam which is not related to operations of the PE.

The income of A taxable in Vietnam is 15 Mio EUR from items b, c and d.

2.3 Foreign Contractor Withholding Tax

The taxation of enterprises registered outside Vietnam is subject to the regime of the Foreign Contractor Withholding Tax (FCWT). This is not a special tax, but a special way of calculating and fulfilling the tax obligation of the foreign taxpayer (the foreign contractor or foreign sub-contractor) esp. regarding the Value Added Tax (VAT) and the CIT.

Normally, the handling of the FCWT is to be fulfilled by the involved Vietnamese party which must calculate and pay the arising tax to the state budget of Vietnam and deduct this amount from the invoiced amount before payment to the foreign contractor.

The FCWT is applied regardless of having a PE or not. For the specific impact and handling, the respective Double Taxation Agreement (DTA) is of importance.

The most important exemption from exposure to the FCWT is about contracts which do not include any kind of service (except for warranty) to be provided within Vietnam.

For details, please refer to our Brochure on the FCWT.

3 Details on CIT

3.1 Tax assessment period

The tax assessment period is either the western calendar year or the financial year of the company. Companies are allowed switching their tax assessment period from the western calendar year to their financial year or vice versa but the regular tax assessment period must equal twelve months. When switching, the tax period of the year in which the change occurs may differ, but never can exceed twelve months.1

The first (in case of a new establishment) or the last tax period (Mergers and Acquisitions, dissolution) can be merged with a regular tax assessment period if not exceeding 3 months.2

3.2 Tax payable

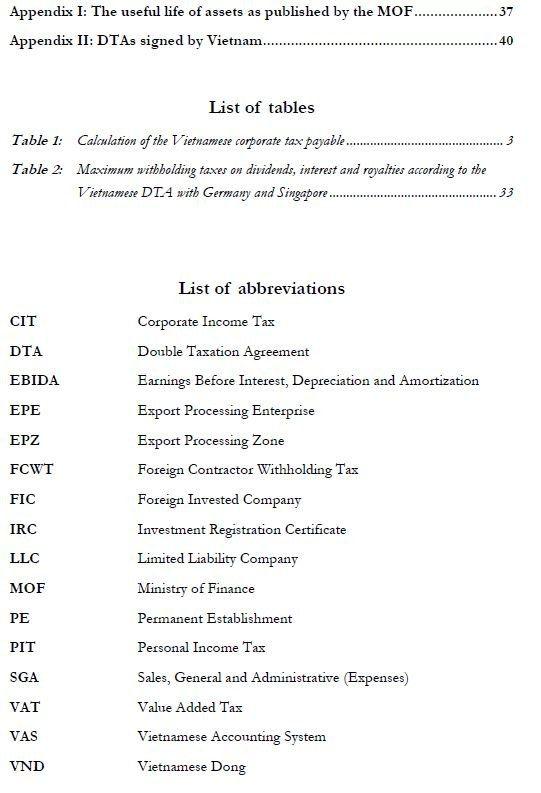

The payable tax is calculated in this way:

_____________________________

1 Example pursuant to Circular 78/2014/TT-BTC: In 2013, enterprise A uses the calendar year as CIT period. At the beginning of 2014, it changes to use the financial year of business (1 April to 31 March) of the subsequent year. The CIT period in the year of change will be counted from 1 January 2014, through 31 March 2014. The subsequent CIT period will be counted from 1 April 2014, through 31 March 2015 (Circular 78/2014/TT-BTC, Article 3, No. 4, Example No. 1).

“Circular 78/2014/TT-BTC” is abbreviated of Circular 78/2014/TT-BTC of 18 June 2014, amended by Circular 119/2014/TT-BTC dated 25 August 2014, also amended by Circular 151/2014/TT-BTC dated 10 October 2014, Circular 96/2015/TT-BTC dated 22 June 2015 and Circular 25/2018/TT-BTC dated 16 March 2018.

2 Example: enterprise A gains the ERC on 1st November 2016 and determines tax period as calendar year. The first CIT period 2016 can be added up to calendar year 2017 ending 31 December 2017 (Circular 78/2014/TT-BTC, Article 3, No. 3.)

4 Turnover

4.1 General information

Turnover is the sum of revenue from the sale of goods, processing fees and fees for providing services including price subsidies, additional charges and fees, irrespective of whether money has been received or not.

If an enterprise pays VAT by the tax credit method (input VAT is creditable from VAT-liability) the turnover used to assess the taxable income excludes the VAT.1 If an enterprise pays VAT by direct method (VAT calculated directly on the added value), the turnover used to assess taxable income includes VAT.2

The point of time for fixing a turnover shall be:

➢ In respect of goods sold: the point of time marking the transfer of ownership.

➢ In respect of services: the point of time marking the completion of service or the partial completion of service.3

➢ In respect of air transport services: the point of time marking the completion of supply of air transport services.4

Turnover in any foreign currency needs to be converted into VND at the actual exchange rate at the time for fixing a turnover above. The actual exchange rate used for recording turnovers is the buying exchange rate5 of the commercial bank where the taxpayer opened accounts.6 It is not possible to implement an average exchange rate or any other exchange rate.

___________________________________

1 Example: Company A is paying VAT using the credit method and sells a good for 100 VND plus 10 VND VAT. The turnover used to assess the taxable income is 100 VND (Circular 78/2014/TT-BTC, Article 5 No. 1).

2 Example: Company B is paying VAT calculated directly on the added value and sells a good for 110 VND including 10 VND VAT. The turnover used to assess the taxable income is 110 VND (Circular 78/2014/TT-BTC, Article 5.No. 1).

3 Circular 78/2014/TT-BTC, Article 5 No. 2 (b) amended by Circular 96/2015/TT-BTC.

4 Circular 78/2014/TT-BTC, Article 5 No.2 (c)

5 Exchange Rates against VND.

6 Circular 156/2013/TT-BTC, Article 27 amended by Circular 26/2015/TT-BTC.

4.2 Regulation of special situationsions1

The turnover of goods and services used for the purpose of exchange (excluding goods and services used to continue the production and business process of the company) shall be assessed based on the selling price of such goods or services in the market at the same time.2

With respect to goods and services sold by way of instalments or deferred payment, turnover shall be calculated on a lump sum payment price excluding any interest.3

Regarding agencies selling goods on commission on behalf of a principal, the turnover shall be the amount of commission.

When processing goods, the turnover shall be the income from processing (processing fees, expenses for servicing the processing).

With respect to the lease out of assets, the turnover shall be the amount of leasing rate paid for each period according to the contract. If leasing rates are paid in advance, they shall be allocated to the period they are paid for.

With respect to golf course business, the turnover shall be the revenue from the sale of membership cards and tickets to play golf and other types of income.4

In case of construction and installment activities, the turnover shall equal the value of the works or items which have been accepted by the customer.

With respect to business activities based on business co-operation contracts, the turnover shall be:

➢ The share of turnover distributed, if the parties distribute their business results in the form of turnover.

➢ The turnover from products distributed, if the parties distribute their business results in the form of products.

____________________________

1 Circular 78/2014/TT-BTC, Article 5 No. 3.

2 Example: Company B is a computer manufacturing company. In the year that company B exports a number of itself manufactured computers to its employees to use for working in the company, these computer products are not required to be converted to turnover for calculating CIT (Circular 78/2014/TT-BTC, Article 5, No. 3, amended by Circular 119/2014/TT-BTC).

3 Circular 78/2014/TT-BTC, Article 5 No. 3 (a).

4 Circular 78/2014/TT-BTC, Article 5 No. 3 (g).

➢ Proceeds from the sale of goods and services, if the parties distribute their business results in the form of pre- or after-tax profits.

In the case of the operation of credit institutions, the turnover shall be the loan interest, the deposit interest, revenue from the finance leasing.1

In case of security business, turnover shall be revenue from brokerage services, securities self-trading, underwriting of issues, portfolio management, financial consultancy, management of funds or certificates issued.

With respect to derivative financial services, turnover shall be proceeds from the provision of such services arising and performed in one period.

With respect to transportation activities, turnover shall be the total turnover from passenger, luggage, and cargo transportation.

With respect to supply of electricity or clean water, turnover shall be the sum recorded in VAT invoice on the date of the meter index reading in the invoice.

With respect to insurance business, turnover used to assess taxable income shall be the whole proceeds from provision of insurance services and other goods and service, including extra charges and additional charges but excluding VAT.

5 Expenses

5.1 General information

The Ministry of Finance (MOF) provided a list of non-deductible expenses. All expenses not mentioned to be non-deductible can be considered being deductible expenses, if:

➢ The expenses arose and are related to the activities of production or business of the enterprise; and

➢ are supported by legally correct invoices and vouchers. For payments to Vietnamese entities, the VAT invoice (also known as a ‘red invoice’) usually is required. For payments to foreign entities, the invoice must follow the legal requirements of the place of registration of the invoicing party. In addition, the underlying agreement usually is required.

➢ The payment has been made via bank transfer. Cash payments are only accepted for payments of under 20 Mio VND including VAT1.

Expenses in foreign currency must be converted into VND at the actual exchange rate at the time such expenses arise.2 The actual exchange rate used for recording expense is the selling exchange rate3 of the commercial bank where the taxpayer opened accounts.

5.2 Non deductible expensesexpenses4

Non-deductible are these expenses:

a) Expenses for non-business purposes;

b) Accruals5;

c) Fines for administrative offenses;

d) Expenses covered by other funding sources (e. g. another enterprise);

e) Business management expenses allocated to a Vietnamese PE from abroad, exceeding the allocable actual expenses;

f) Expenses exceeding the allowed level for contingency reserves;

g) That part of an interest payment exceeding 150% of the basic interest rate of 9% as published by the State Bank6 if not paid to a credit institution. Loan interest expenses paid to related party exceeding 30% EBIDA (earnings before interest, depreciation, and amortization)7;

h) Remuneration paid to founding members who are not directly involved in executive management8;

______________________________

1 Circular 78/2014/TT-BTC, Article 6 No. 1 (c)

2 Circular 156/2013/TT-BTC, Article 27 (amended by Circular 26/2015/TT-BTC)

3 Exchange Rates against VND

4 For further information: Circular 78/2014/TT-BTC, Article 6

5 Expenses allocated in advance for a term or cycle but not actually spent or not spent in full as they don’t actually arise except case of the expenses corresponding to the recorded turnover.

6 The basic interest rate of VND is 9% per annum applied from 01 December 2010 by Decision No. 2868/QD-NHNN dated 29/11/2010.

7 Decree 132/2020/ND-CP dated 05 Nov 2020 (which takes effect from 20 December 2020), Article 16.3.

8 Official Letter 80200/CT-TTHT dated 23.10.2019 of Department of Taxation of Ha Noi City referring to Clause 2.6, Article 6 Circular 78/2014/TT-BTC, amended at Article 4 of Circular 96/2015/TT-BTC

i) Remuneration accounted to be paid to employees but not actually paid or without invoices or payments which are not clearly mentioned in the labor contract with a specific amount;

j) Interest payment on loan provided at times when the charter capital has not been fully paid;

k) Credited VAT;

l) Financial aid/subsidies, except for aid in order to overcome the consequences of natural disaster, to build charitable homes or to support programs in special socio-economic areas;

m) The part of expenses for voluntary retirement insurance exceeding the cap of 1 million VND a month per person;

n) Expenses for business activities being banking, insurance, lotteries or securities;

o) Depreciation for fixed assets which aren’t used for production or business1 and depreciation exceeding the rates fixed in the regulations of the MOF2;

p) Interest due to late payment of tax liabilities3;

5.3 Deductible expenses

5.3.1 Costs of goods sold

Cost of raw materials, supplies, fuel, power, and goods are deductible if they arose and are accompanied by a legally correct invoice.

However, expenses for the purchase of goods and services without official invoices can be deducted if the enterprise can prepare a list of external purchase of goods and services accompanied by the payment vouchers (Non-cash payment vouchers are not mandatory) in some cases:

_________________________

1 Circular 78/2014/TT-BTC, Article 6, No. 2.2 (a).

2 An enterprise having economically efficient operation may depreciate fixed assets faster than applicable in the standard, but the maximum rate of depreciation shall not exceed twice the rate of depreciation fixed in accordance with the straight-line depreciation method in order to rapidly reform its technology. The enterprise must ensure profitable business when adopting faster depreciation. (Circular 78/2014/TT-BTC, Article 6, No. 2.2 (d).

3 Decree 218/2013/ND-CP dated 26 December 2013 (amended by Decree 91/2014/ND-CP dated 1 October 2014, Decree 12/

➢ Agricultural, seafood or aquaculture products purchased from the producer or from the fisherman.

➢ Products made directly by farmers from rattan, bamboo, reed, coconut or grass.

➢ Soil, stone, sand or gravel mined by the direct sellers.

➢ Scrap sold by persons who collected it themselves.

➢ Appliances, assets and services sold directly by a non-business household and a non-business individual.

➢ Goods and services provided by a business household or an individual that have an annual revenue of less than 100 million VND.

If purchase prices of goods and services on the list are higher than the market prices at the time of purchase, the tax department may rely on the market price at the time of purchase of goods and services of the same or similar type to re-fix prices for the purposes of re-determining reasonable expenses when calculating taxable income.

For this reason, information on the market price should be collected and kept in a documentation.

5.3.2 Labor costs

Expenses being salaries, wages and bonuses are deductible if they are paid in compliance with the labor contract or internal labor rules. Payroll and PIT calculation must be available. The labor contract must be in writing, so all agreements on payments must be in writing and must be mentioning the specific amount to be paid.

Remuneration paid to founders and members of the members’ council or board of directors who do not personally participate in administering the business activities of the enterprise are also non-deductible.1

Payments in the form of 13th or 14th month salary or other fixed payments are deductible.

Additional payments for house rental, electricity and water consumption fees are deductible if managed according to the guidelines of the MOF.2

_____________________________

1 Circular 78/2014/TT-BTC, Article 6, No. 2.6. (d)

2 Circular 78/2014/TT-BTC, Article 6, No. 2.5 (b) state house rental fees, electricity, water consumption fees paid to foreign employees (expatriates) to be deductible. However, in order to be deductible this fees/rent must be defined as additional wages by one of the following documents: the labor contract, the collective

Expenses for uniforms paid to employees in money exceeding an amount of five million VND per person per year and in kind if not supported by complete invoices and vouchers are non-deductible.1

Reimbursement of travel expenses paid to employees being on business trips is deductible if it is following the required administrative procedures. In many cases, a writing company travel policy is required. 2

Travel allowances for staff on holiday leave must be in accordance with the provisions of the labor code to be deductible.3

Contributions to life insurance for employees are fully deductible if stipulated in labor contract, collective agreement, financial policies, or remuneration policies of enterprises.

In case the contract between a Vietnamese party and an overseas party clearly stipulates that the Vietnamese party shall be responsible for housing expenses for foreign employees coming to Vietnam for business purposes, these housing expenses are deductible4.

5.3.3 Depreciation

5.3.3.1 General information

Depreciation must follow the specific regulations of the MOF. Both tangible and intangible assets may be depreciated. Tangible assets comprise buildings, plants

_______________________

labor agreement, the regulations on finances of the company or the regulations on bonuses and be accompanied by legal invoices including name, address and tax code of the enterprise paying these additional wages.

1 Circular 78/2014/TT-BTC, Article 6, No. 2.6.

2 Circular 78/2014/TT-BTC, Article 6, No. 2.8. When purchasing air tickets for its employee’s business trip through e-commerce website, vouchers as the basis for calculating deductible expenses includes electronic flight ticket, boarding pass and non-cash payment voucher.

3 Circular 78/2014/TT-BTC, Article 6, No. 2.8, the Decree 145/2020 guiding on the Labor Code hardly offers any restrictions on travel allowances as literally stated in Article 67: ‘travel expenses and salary in the traveling days shall be agreed by both parties.’

4 Circular 78/2014/TT-BTC, Article 6, No. 2.6 (b)

machinery and equipment, vehicles, and others. Intangible Assets are comprising: land use rights1, software, copyrights, trademarks2 and others.

The assets must meet all the following conditions:3

a) Economic benefit will be attained from the future use of this asset.

b) The useful life of the asset exceeds one year.

c) The original costs of the assets can be identified reliably and with an amount of at least 30 million VND.

The cost for any asset failing to meet these conditions will be accounted directly as expense.

Depreciation is calculated on the historical cost price (original cost) of a tangible or intangible asset, comprising:

d) The purchasing price.

e) Taxes paid (excluding refundable taxes).

f) Transportation costs.

g) Interest expense incurred for purposes of investing in the asset.

h) Installation and testing costs.

i) Registration costs.

If an enterprise is depreciating fixed assets produced by its own, the historical cost price of such assets shall comprise the total expenses of production.4

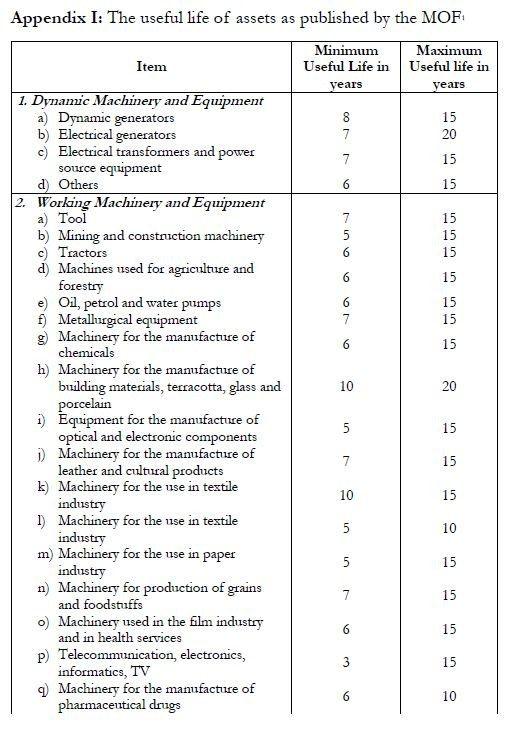

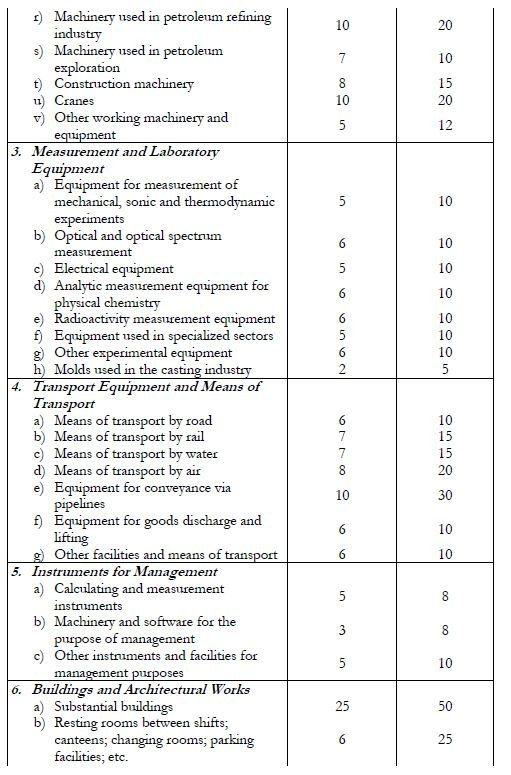

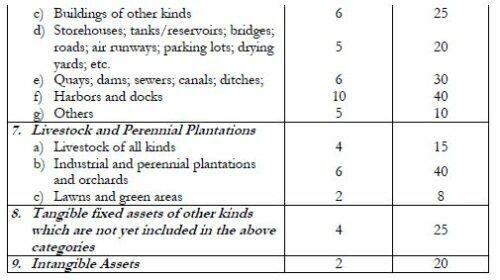

Depreciating this gross value, enterprises need to determine the useful life of the underlying asset. Regularly, this will follow the list published by the MOF. Please refer to the Appendix I of this Brochure.

________________

1 Long-term land use rights cannot be depreciated. Land use right for a definite term participating in production or business activities may be gradually allocated to deductible expenses if there are adequate source vouchers and the legal procedures required by law. (Circular 78/2014/TT-BTC, Article 6, No. 2.2 (e))

2 Expenses for purchasing and using technical data, copyrights, technology licenses, trademarks, goodwill and so forth may be allocated to business costs and gradually deducted for a maximum period of 3 years. Software may be depreciated over a period of 3-8 years.

3 Circular 45/2013/TT-BTC Article 3 (amended by Circular 147/2016/TT-BTC, Circular 28/2017/TT-BTC).

4 For further information on the determination of historical prices: Circular 45/2013/TT-BTC, Article 4.

The methods of depreciation are:

a) Straight-line depreciation: depreciation at fixed rates depending on the underlying asset and the respective assumed useful life as published by the MOF (e. g. 10 years useful life; 10% depreciation per year).

Accelerated rates: depreciation at an accelerate way of straight-line depreciation applied to enterprises with high business effectiveness. The enterprise must ensure that its business is profitable. Using this method enterprises are allowed to increase the depreciation rate to a maximum of twice the rate as fixed by the straight-line method.1 Each year enterprises shall make decision on the rate of such depreciation in accordance with regulations.

b) Declined balance depreciation: This method of depreciation is only applicable to enterprises operating in fast-developing technology businesses to depreciate new machinery, equipment, and laboratory equipment in a fast way.

c) Production output depreciation: Depreciation based on output. Applicable to machinery or equipment directly related to production which monthly capacity is not lower than 100% of the designed capacity.

Enterprises must notify the tax authority which of the depreciation methods they select to apply before commencing applying such method for each fixed asset. Furthermore, they must apply the chosen method consistently throughout the useful life of the asset. Under special circumstances enterprises can change the method of depreciation but only a one-time change is accepted. In such cases, they need to report the reasons for changing the depreciation method to the tax authority.

Any upgrading of fixed assets is a capital expenditure and is deemed to increase the value of the upgraded asset. If an asset is merely repaired the amount paid for reparation is gradually accounted as (deductible) expense within three years.

5.3.3.2 Regulation of special situations

Leased assets which are leased by finance leasing need to be accounted as if they belong to the enterprise (capitalization in the enterprise’s balance sheet, depreciation).2 Leased assets which are leased by operating leasing are treated as

_________________

1 Circular 78/2014/TT-BTC, Article 6, No. 2.2 (d).

2 Leasing expenses cannot be accounted as business expenses as the asset is capitalized in the balance sheet and expenses for depreciation are accounted.

business expense.1 Finance leasing is assumed where the total lease payments equal the value of the underlying asset at the time when the leasing contract was signed and the leasing entity has the right upon the expiry of the contract either to buy the underlying asset or to prolong the contract at the same conditions.2

Fixed assets which are not used for production and business of goods and services or for which there is no document proving ownership are not depreciable. Fixed assets serving employees working for the enterprise (e. g. cafeteria, rooms for breaks, library, kindergarten, sport complex and the related machineries and equipment etc.) are regarded to be used for business of goods and services.3

Assets being instruments, tools, recyclable packaging etc. which are not eligible for fixed assets are not allowed for depreciation. However, the expenses for purchasing such assets may be gradually allocated to expenses of production and business over a maximum period of three years4.

Goodwill is not considered to be an asset according to the Vietnamese tax legislation. Expenses related to goodwill must be classified as business expenses and can only be deducted for up to three years after the commencement of operations5. In case of goodwill considered as capital contribution, allocated expense shall be non-deductible.

That part of depreciation corresponding to the original cost of a newly registered automobile of nine seats or less, exceeding 1.6 billion VND (around 65.000 Euro) is non-deductible. The automobiles specialized in the field of transportation, tourism or hotel services are exempt from this legislation.6

5.3.4 Sales, general and administrative expenses

Business management expenses allocated by overseas companies to their permanent establishments (“PE”) in Vietnam are deductible if the PE adopts the Vietnamese Accounting System (VAS) for advertising, marketing, promotion and brokers’ commissions, expenses for reception, formal occasions and conferences, expenses for

____________________

1 No capitalization in the enterprise’s balance sheet, no depreciation, leasing fees are accounted as business expenses of the respective period (Circular 45/2013/TT-BTC, Article 8).

2 Circular 45/2013/TT-BTC, Article 2.

3 Circular 78/2014/TT-BTC, Article 6, No. 2.2 (a)

4 Circular 78/2014/TT-BTC, Article 6, No. 2.2 (d).

5 Circular 78/2014/TT-BTC, Article 6, No. 2.16.

6 Circular 78/2014/TT-BTC, Article 6, No. 2.2 (e)

assisting marketing, discounting payments is fully deductible if having adequate invoices and vouchers.

Costs of electricity and water are non-deductible if the contract for the electricity/water supply is signed by the lessor of the business location and there are insufficient vouchers proving the payment of those costs through the enterprise.1

5.3.5 Reserves

The following reserves may be accounted as (deductible) expenses if established pursuant to the guidelines of the MOF:2

a) Reserves for a decline in the price of inventory.

b) Reserves for losses of financial investments.

c) Reserves for bad debts.3

d) Reserves for warranties.

e) Reserves for occupational risks for enterprises providing business valuation services and enterprises providing independent audit services.

At the end of the period any balance in the reserves for a decline in the price of inventory or financial investments as well as any reserve for bad debts must be reversed by reducing expenses accordingly. Balances in the reserve for warranties must be reversed by recording these balances as other income.4

In addition to the above mentioned, enterprises can set up a contingency fund for salaries, wages and allowances payable to employees but not in fact been paid till the tax finalization. However, the amount of such contingency fund must not exceed 17% of the total amount of salaries which were paid in the period upon the tax finalization.5

_________________________

1 Vouchers are considered as insufficient if the enterprise pays the cost of electricity/water to the lessor or directly to the supplier without receiving invoices for payment and without a lease contract for the business location (Circular 78/2014/TT-BTC, Article 6, No. 2.15).

2 Circular 78/2014/TT-BTC, Article 6, No. 2.19.

The guidelines of the MOF can be found at Circular 48/2019/TT-BTC.

3 In order to constitute a reserve for a bad debt, the underlying debt must be either overdue or the debtor must have been fallen into bankruptcy. For debts overdue the amount of reserve is limited as follows: 30% of the value of debt if overdue between 6 months and 1 year, 50% of the value of debt if overdue less than 2 years, 70% if overdue less than 3 years, 100% if overdue more than 3 years. For debts where the client has fallen into bankruptcy status, is making dissolution procedures or disappeared, the enterprise estimates the amount of irrecoverable loss in order to constitute the reserve. (Circular 228/2009/TT-BTC, Article 6)

4 Circular 48/2019/TT-BTC, Article 7.4

5 Decree 218/2013/ND-CP, Article 9, No. 2 (m).

5.3.6 Dividends, interest and royalties

Expenses directly relating to an issue of shares and dividends on shares are not deductible except for the shares and dividends being a type of debt payable1.

Payments of interest on loans are deductible expenses.2 Wherever the interest of a loan not received from a credit institution or economic organization like foreign company exceeds 150% of the basic interest rate announced by the State Bank at the date of the loan,3 that part of the interest is non-deductible. Interest payments that may be associated to the lack of contributing legal capital are non-deductible.4

Royalties are deductible to a reasonable amount.

5.3.7 Other

Enterprises established pursuant to the law of Vietnam can deduct up to 10% of their annual assessable income in order to establish a Science and Development Fund. Expenses made by this fund cannot be accounted by the enterprise as deductible expense. The contribution to the fund already was accounted as deductible expense. If this fund doesn’t use up at least seventy percent of the contributed funds within a period of five years or uses them for incorrect purposes, the enterprise must pay CIT calculated on that part of income which was taken to establish the fund.

Taxes that are deductible include the following:

a) Input VAT which cannot be credited against the VAT-liability.

b) The amount of CIT paid on behalf of foreign contractors under regime of the FCWT.5 However, this must be included in the invoice provided by the foreign contractor being issued in accordance with the contract. So, the deductible expense is defined by the valid invoice and not by the calculation of the FCWTCIT. The FCWT-CIT is tax payment of the foreign contractor and as such not deductible expense of the Vietnamese company.

______________________

“Decree 218/2013/ND-CP” means: Decree 218/2013/ND-CP dated 26 December 2013, amended by Decree 91/2014/ND-CP dated 1 October 2014, Decree 12/2015/ND-CP dated 12 February 2015 and Decree 146/2017/ND-CP

1 Decree 218/2013/ND-CP, Article 9, No. 2 (r).

2 For further information about the handling of interest please also check chapter 6.2 about Other Income.

3 The basic interest rate of Vietnamese dong is 9% per annum applied from 01 December 2010 by Decision No. 2868/QD-NHNN.

4 Circular 78/2014/TT-BTC, Article 6, No. 2.18; Example: The charter capital payable in year 1 of an enterprise is 10 million USD, the loan capital is 15 million USD. However, only 8 million USD of charter capital were actually contributed during the first year. Based on these facts the Vietnamese tax authorities would assume the enterprise to have used 2 million USD of loan capital in order to finance the shortage of the charter capital. Therefore, only the interest relating to 13 of the 15 million USD would be deductible.

5 Circular 78/2014/TT-BTC, Article 6, No. 2.37.

c) Import and export duties.

d) The amount of PIT in case the parties agreed in the labor contract on a “net-salary” paid to the employee which does not include the PIT. However, such agreement must be interpreted in the way, that parties also in that case agree that the employer must pay the gross salary and from that amount calculate and deduct the PIT. Following this interpretation, the deductible expense is defined by the gross salary defined by grossing up the defined net salary and not by the PIT calculation. The PIT is always paid on behalf of the employees and withheld on behalf of the governmental body. The amount of PIT paid is already included in the accounted costs of labor (the gross salary) which are deductible.

Expenses related to a loss due to natural disaster, epidemic or other event of force majeure for which compensation is not payable are deductible. For deducting these expenses, the enterprise itself must specify the total value of loss by an inventory.1

Losses resulting from changes in exchange rates are deductible at the time they are recognized. 2 In case losses resulting from changes in exchange rates which are not directly related to the main business activities, they are considered as financial expense and are deductible. Exchange rate losses from re-assessing of monetary items at the end of the tax period are not deductible (except for losses caused by the re-assessment of debts).3

Charitable contributions are not deductible except for the contributions mentioned in the following: Donations for educational purposes are deductible if paid to public or private schools, as scholarship for students or for funding competitions in school subjects or establishing educational funds. Donations for medical health care, remedying consequences of natural disaster and funding for charitable housing are also deductible if fulfilling the specific conditions. Donations for scientific research,remedy of the consequence of a natural calamity, construction of charity houses or houses for the poor are deductible if paid to appropriate beneficiaries.1

Organizational expenses like expenses for the establishment of an enterprise, training expenses and advertising expenses incurred before establishing the enterprise cannot be accounted as intangible assets. Therefore, no amortization of intangible assets is applicable. However, they may be amortized as business expenses over a maximum period of three years upon the establishment of business.2 For recognizing such pre-establishment expenses, a special regime is required.

_____________________

1 Circular 78/2014/TT-BTC, Article 6, No. 2.1.

2 Circular 78/2014/TT-BTC, Article 7, No. 9.

3 Example 1: a trade receivable in USD 100 is caused in October (value in VND 2.1 million), at the end of the tax period the dollar has appreciated (new value of receivable 2 million VND). This loss is not deductible till actually arose.

Example 2: a debt in foreign currency is caused in October worth 3 million VND, at the end of the period the VND depreciated (new value of debt 3.2 million VND). A loss of 0.2 million VND is deductible, even if not actually arose.

6 Other taxable income

6.1 General information

The term ‘other taxable income’ (also known as ‘irregular income’) comprises all types of income derived by business entities not being income from activities of production and business in goods and services. All types of other income mentioned in the following chapters are subject to the common CIT-rate of 20%.

6.2 Types of other income

6.2.1 Capital assignment

Income from capital assignment is defined as income from a transfer of ownership. Relevant is the time when the ownership is transferred.3 The assessable income is determined as follows:

![]()

The price of assignment is the actual total value receivable by the assignor as stipulated in the assignment contract. If the assignment is not paid by money but in the form of assets or other material benefits, the price of assignment is fixed as the market purchasing price of the received assets/materials. 4 If the enterprise conducts its cost accounting in foreign currency and the purchasing price is paid in foreign currency too, then the price of assignment may be fixed in foreign currency. If the cost accounting is in VND but the price of assignment is paid in foreign currency, then the purchasing price of the assignment needs to be converted into VND. The buying exchange rate as published by the commercial bank in Vietnam where the taxpayer opened bank account must be applied.

The purchasing price of the assignment shall be the value of portion of capital contribution based on the accounting books. If the assigned capital also resulted from acquisition before, the prime cost of acquisition is fixed as purchasing price.

All actual costs directly related to the assignment of capital and accompanied by valid vouchers and invoices are considered as deductible assignment expenses.1 Assignment expenses comprise expenses in order to conduct the legal procedures of assignment, fees and charges related to the assignment, expenses for transacting, negotiating and signing the assignment contract and other reasonable expenses with proper evidence.

In case of capital assignments where the transfer company is a foreign entity, the assignee is responsible to determine, declare and withhold CIT on behalf of such a foreign organization.2

___________________

1 Circular 78/2014/TT-BTC, Article 6, No. 2.23-2.26. Donations not mentioned in this Articles are non-deductible.

2 Circular 45/2013/TT-BTC, Article 3, No. 3.

3 Circular 78/2014/TT-BTC, Article 14, No. 1.

4 If the assignment contract provides payments in installments, interest payable on such installments shall not be included in the assessable income of capital assignment. If the assignment contract doesn’t stipulate any purchasing price or the stipulated purchasing price appears to be inconsistent with the market value of such assignment, then the tax authorities have the right to fix the purchasing price (Circular 78/2014/TT-BTC, Article 14, No. 2(a)).

6.2.2 Securities transfer

Income from securities transfer is income earned from the transfer of shares, bonds, fund certificates and other securities. The assessable income is determined as follows:

![]()

The selling price shall be the actual securities selling price (i.e. order-matching price or agreed price) announced by the Stock Exchange Center or the selling price in the transfer contract in case the company is not registered at a Stock Exchange Centre.

The purchasing price shall be the actual purchasing price announced by the Stock Exchange Centre at the time buying the securities. In case the company is not registered at a Stock Exchange Centre, the purchasing price shall be the price recorded

in the transfer contract. In case the company purchases the securities at an auction, the purchasing price shall be the winning bid price announced by the auctioneer.

All expenses directly related to the transfer, having valid invoices and source vouchers are deductible. Expenses directly related to the transfer comprise expenses for legal procedures, fees and charges related to the transfer, fees for depositing securities, fees for entrusting the securities, expenses for transacting, negotiating and signing the transfer contract and other expenses with proper evidence.1

___________________

1 Expenses arisen overseas must be notarized by an authorized body of the foreign country and translated into Vietnamese (Circular 78/2014/TT-BTC, Article 14, No. 2(a)).

2 If the assignee also is a foreign organization, then the enterprise established according to the Vietnamese law where such foreign organization invests capital is responsible to determine, declare and withhold CIT (Circular 78/2014/TT-BTC, Article 14, No. 2(c)).

_______________

1 Circular 78/2014/TT-BTC, Article 15, No.2.

2 Circular 78/2014/TT-BTC, Article 16, No.2.

3 If the price of a land transferred is below the land price stipulated by the provincial people’s committee as at the date of signing the contract, then the price stipulated by the provincial people’s committee shall apply (Circular 78/2014/TT-BTC, Article 17, No.1 (a1)).

4 Circular 78/2014/TT-BTC, Article 17, No.1 (a2) additionally defines the assessable turnover of real property transfers for a number of specific situations, comprising situations of sub-leasing, situations of enterprises being entitled to CIT incentives selling the property or situations of credit institutions selling the property.

6.2.3 Real estate transfer

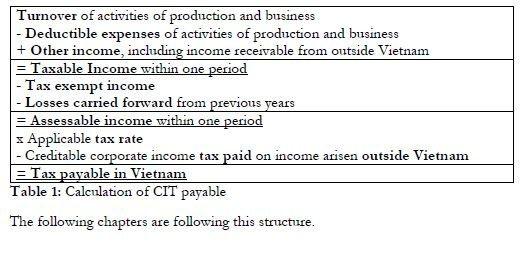

Income from real estate transfer comprises income from the transfer of land use/lease rights, income from transfer of houses or construction works regardless of whether the underlying land use/lease right is transferred, income from the transfer of assets attached to the transferred land, houses or construction works and income from the transfer of right to use a residential house.2 The assessable income from real property transfers is defined to equal the taxable income less the carried forward losses from real property activities of previous years. Whereas the taxable income is defined as follows:

The turnover receivable from real property transfers equals the actual price of the transfer including any fees and extra charges under the contract in compliance with the law.3 The point of time to calculate the tax assessable turnover is the time when the seller delivers the real property to the purchaser, irrespective of the registering of ownership.4

For the prime cost of real property there is no explicit definition under the Vietnamese legislation. However, the prime cost actually arisen when obtaining the real property and provable by valid documents may be deducted.1

Deductible transfer expenses must correspond with the turnover receivable. Transfer expenses comprise:2

a) Costs being compensation for loss and damage to land;

b) Cost being compensation for loss of crops;

c) Costs being compensation and assistance for resettlement;

d) Costs being fees and charges for relating to the issuance of land use rights;

e) Costs for land improvement;

f) Costs being expenses on construction of infrastructure;3

g) Other expenses directly related to the assignment of the real property.

Appearing negative amounts (losses) of taxable income from real property transfers can be offset against profits from other business activities in the same tax year.4 If there remain losses after the offsetting, losses may be carried forward to taxable income from real property transfer for a maximum period of 5 consecutive years as from the year following the year in which the loss arose. In contrast, profit of real property transfers cannot be offset against losses from any other type of income except for the case of liquidation of real estate considered as fixed assets incurred during dissolution process.

If a real estate project is partially completed and gradually transferred during the completion progress, then expenses shall be divided by the total square meter of the land and allocated to the land area assigned by multiplying with the square meter of the transferred land.

____________________

1 Further explanations how to assess the prime cost of land received: from another entity, from the State, as capital contribution, in exchange for a building, from an auction, as an inheritance are given in Circular 78/2014/TT-BTC, Article 17, No.1 (b2).

2 Circular 78/2014/TT-BTC, Article 17, No. 1 (b2).

3 Infrastructure comprises roads, power, water supply and water discharge systems, posts and telecommunication and others (Circular 78/2014/TT-BTC, Article 17, No. 1 (b2)).

4 Circular 78/2014/TT-BTC, Article 4. 2

6.2.4 Ownership rights and using rights of assets

Income from ownership or rights to use assets comprises income from all forms of copyright paid for ownership of or right to use assets; income from intellectual property rights; and income from technology transfer.1

Income from royalties of intellectual property and technology transfer equals the total income receivable less (-) prime cost or expenses for creating, less (-) expenses for maintaining, upgrading and developing and other deductible expenses.

6.2.5 Transfer or lease out of assets

Income from the transfer of assets (except for the transfer of real property) comprises monetary or non-monetary receivables from assignment or liquidation of assets. The assessable income from the transfer of assets is fixed as the amount receivable deducted by the residual value of the underlying asset at the time the transfer/liquidation arises. Whereas the time of liquidation is determined by the transfer of ownership.2

Income from leasing out of assets equals the turnover receivable from leasing activities less expenses of depreciating, maintaining, repairing, and preserving the assets, less other deductible expenses (if any).3

6.2.6 Exchange rate differences

Income from exchange rate differences arises during tax year or from reassessing foreign currency debts at the end of the year.4 However when such differences appear and they are directly related to revenue and expenses of the main business of the company, they shall be included in the income/expense of such activity. Income from exchange rate differences not related to the main business of the company shall be accounted as other taxable income. Negative income from exchange rate differences not related to the main business of the company shall be included in the deductible expenses of the main business as illustrated in chapter 5.3.75

Exchange rate gains arising from the reassessment of foreign currency debts shall be set off against losses from the reassessment of foreign currency debts. The residual profit shall be accounted as other income.1

______________________

1 Circular 78/2014/TT-BTC, Article 7, No. 4.

2 Circular 78/2014/TT-BTC, Article 7, No. 6.

3 Circular 78/2014/TT-BTC, Article 7, No. 5.

4 Gains from the reassessing of cash, money in the course of remittance and foreign currency debts recoverable cannot be accounted as income for CIT purposes (Circular 78/2012/TT-BTC, Article 7, No. 9).

5 Circular 78/2014/TT-BTC, Article 7, No. 9, 1st bullet point, last sentence.

6.2.7 Production and other business executed abroad

Income from business abroad is other income. Incentive tax rates applicable to the Vietnamese sourced income of that enterprise cannot be applied to the foreign sourced income. This other income is to be recorded at the time of profit remittance. Losses from business abroad cannot be offset against Vietnam-soured income. 2

Foreign paid taxes generally can be credited against the Vietnamese tax payable. For further information check chapter 10.

6.2.8 Further types of other income

Further types of other income are: 3

a) Income from the transfer of a project or implement a project.

b) Income from the right to explore, mine or process minerals.

c) Income from interest.4

d) Income from the sale of foreign currency.5

e) Income from bad debts which were written off and now are repaid.

f) Income from accounts payable for which the creditor cannot be identified.

g) Newly discovered income omitted in previous years.

h) Income from fines and compensations payable by another contracting party.

i) Income being gifts or donations in cash or kind.

j) Income from the revaluation of assets except the income which results from the revaluation of assets for capital contribution and transfer after the enterprise is separated/ incorporated/ merged/ transformed under the plan to equitize, restructure and renew entirely state-owned enterprises.1

k) Income from sales of waste materials.2

l) Other items defined as income by law.

_________________________

1 Circular 78/2014/TT-BTC, Article 7.9.

2 Circular 78/2014/TT-BTC, Article 3.1.

3 Circular 78/2014/TT-BTC, Article 7.

4 If there is a positive balance when deducting the interest paid from the interest received, then such balance shall be accounted as other taxable income. If the before mentioned balance is negative, then it shall be included in the deductible expenses as mentioned in chapter 5.3.6 (Circular 78/2014/TT-BTC, Article 7, No. 7.)

5 Such income shall equal the total receipts from such a sale less the purchasing price of the quantity sold (Circular 78/2014/TT-BTC, Article 7, No. 8.)

7. Tax exempt income

The following types of income are considered by the Vietnamese legislations on CIT to be tax-exempt:3

a) Income earned from cultivation, husbandry, agricultural and aquaculture processing, salt production.4

b) Income earned from fishing activities.

c) Income earned from technical services directly serving agricultural production.

d) Income earned from: performance of contracts for scientific research and technological development, sale of products during their test production, products made from new technology applied in Vietnam for the first time.5

e) Income earned from activities of business and production by enterprises having an average number of 30% or more employees being disabled, reformed drug addicts, or infected with HIV.6

f) Income earned from occupational training for ethnic minorities, disabled people, children living in particularly difficult conditions and reformed offenders.

g) Income distributed from activities being capital contribution, purchase of shareholding, joint-venture or co-operation, distributed by a domestic company after paying tax in accordance with the law on CIT on that income (dividends).1

h) Aid funds receivable for use for educational, scientific research, cultural, artistic, charitable, humanitarian, and other social activities in Vietnam.

i) Income from transfer of certified emission reductions (CERS) of enterprises issued with certificates of emission reduction.

j) Income from the transfer of technology if prior technology transferred to organizations/individuals in areas with special socio-economic conditions.

k) Received profit distribution from a corporation registered in Vietnam.

______________

1 Income from revaluation of assets is defined as the difference between the re-valued value and the residual book value of the underlying asset. Revaluation of assets may appear in terms of divisions, de-merger, merger, consolidation or conversion of business (Circular 78/2014/TT-BTC, Article 7, No. 14 amended by Circular 151/2014/TT-BTC).

2 Costs for collection and costs of sales can be deducted from such income (Circular 78/2014/TT-BTC, Article 7, No. 19).

3 Law on CIT, Article 4. Please note that in this part, we only list the remarkable exemption.

4 Only if earned by organizations established pursuant to the Law on Co-operatives or by the companies located in geographical areas with special difficult socio-economic conditions.

5 In such cases the tax exemption shall not exceed three years from the date of commencement of having turnover from performing the contract for science research and applying new technology and five years from the date of commencement of having turnover form selling products made from applying new technology. In order to be tax exempt, scientific research must be registered and certificated by the State body in case of income from contracts of scientific research. In case of income generated by the sale of new products, these products must be certificated by the State administrative body to be applied in Vietnam for the first time (Circular 78/2014/TT-BTC, Article 8, No. 3 amended by Circular 151/2014/TT-BTC).

6 Exempt income does only include income from business and production, irregular income earned by such an enterprise is taxable. The tax exemption does not apply to enterprises operating in the sectors of finance or real estate business. Enterprises having a total number of less than 20 employees are not entitled to this tax exemption either. In order to be entitled to this tax exemption enterprises must have certification from

8. Losses carried forward

Losses are negative amounts of taxable income.2 They can be carried forward to the following year and be deducted from the assessable income arising in that year. The carrying forward of a loss is continuous and limited to a maximum period of five consecutive years, counting from the year following the year the losses arise. There is no limitation on the amount of loss carried forward.3

Losses incurred prior to a company separation or division are also allowed to be carried forward with a respective equity ratio for the successor companies.1

Losses arising from activities being real estate transfer, transfer of an investment project (except for mineral exploration and mineral extraction projects) shall be accepted to be offset against the profit in the same tax period. If a loss remains after the offsetting, losses can be carried forward to the assessable income from such activities for a maximum period of five years.2

____________________

the medical health authority and drug reform center about the number of disabled, HIV-infected and reformed drug addicted employees (Circular 78/2014/TT-BTC, Article 8, No. 4).

1 Tax incentives to which the distributing entity is entitled do not affect the tax exemption of the distributed dividends. Example: Company A generates an income of 100 billion VND. As it is entitled to us a preferential tax rate of 10% the distributable profit is 90 billion VND. Company B which is the recipient of this distribution, is allowed to fully exempt this 90 billion VND from CIT according to Circular 78/2014/TT-BTC, Article 8, No. 6.

Dividends received from a foreign entity are not covered by this tax exemption and will be included in the taxable income of the Vietnamese company receiving such dividends. However, any foreign tax which is paid on the part of income out of which dividends are paid will be deductible against the CIT payable in Vietnam, up to the Vietnamese tax payable on that income.

2 Circular 78/2014/TT-BTC, Article 9.

3 Example 1: Enterprise A suffers a loss of VND 10 billion in 2013. In 2014 it has a taxable income of VND 12 billion. The loss can completely be carried forward to 2014 and offset against the taxable income of that year.

Example 2: Enterprise B suffers a loss of VND 20 billion in 2013. In 2014, it has a taxable income of VND 15 billion. The loss can partially be carried forward to 2014 and offset against the taxable income of that year.

The remaining loss of VND 5 billion can be carried forward up to 2018.

9. Tax rate and tax incentives

9.1 Standard tax rate

The standard CIT-rate is 20%.

For activities of prospecting, exploring and mining petroleum, gas or other rare and precious natural resources in Vietnam a special CIT-rate between 32% and 50% applies, depending on each specific project/business establishment.

9.2 Special regime in response to the COVID 19 pandemic

In response to the pandemic, all CIT payable for the year 2020 is reduced by 30 % if the enterprise has total turnover in 2020 not exceeding 200 billion.3

Total turnover is specific determined at chapter 4.

9.3 Tax incentives

Vietnam is very reluctant granting direct subsidies. It rather offers various tax benefits for operating in specific economic fields or geographic areas to take influence on the economic development of those areas/fields

9.3.1 Decision on CIT incentives

A FIC will have received an Investment Registration Certificate (IRC). In the application for the IRC the investor must indicate (besides other contents) the requested tax incentives4. If granted they will be mentioned in the IRC.5 Mostly, they will not be listed there in detail. In case no IRC is issued (for example if the project does not have a foreign investor) the tax incentives will be granted in other form.1 It is normally advisable, to have the specifically applicable benefits confirmed by the local tax authority.

These tax benefits being granted for improving investment conditions are not to be mixed with the decision of tax authority on tax exemption or tax reduction in cases where the taxpayer has suffered from material damage caused, or where production or business is directly affected, by natural disasters, fires or accidents.

_________________

1 Circular 78/2014/TT-BTC, Article 9.3

2 Law on CIT, Article 7 No. 3 & Article 16, No. 2.

3 Decree 114/2020/ND-CP dated 25 September 2020

4 Law on Investment 2020, Article 33, No. 1 (d).

5 Law on Investment 2020, Article 17 and Article 40. 9.

9.3.2 Conditions for the application of CIT incentives

Any enterprise aiming to apply one of the tax incentives illustrated in this chapter must implement the Vietnamese Accounting System (VAS) and declare and pay taxes in accordance with its declarations2.

If the enterprise conducts different business activities, it must conduct separate accounting for that part of income entitled for tax incentives as tax incentives can only be applied on the amount of corporate income fulfilling the respective conditions.3

If an enterprise that is entitled to a certain tax incentive for a definite period fails to satisfy the respective conditions at any year during the tax incentive period, then it shall not be entitled for such incentives for that year and must pay tax at the standard rate.4

Losses appearing from business activities entitled to tax incentives can be offset against profits from activities of business and production or other income, excluding income from real property transfers, transfers of a project, income from a transfer of a right to implement a project or to exploit or process minerals.5

Enterprises must self-determine whether they are fulfilling the conditions for a granted tax incentive or not. The tax authority might challenge the taken decisions, especially resulting from a conducted tax audit. The tax authority might impose penalties if discovering an administrative offence in relation to taxation.1

________________

1 Law on Investment 2020, Article 17

2 Circular 78/2014/TT_BTC, Article 18, No. 1.

3 If it fails to do so, the part of income entitled for tax incentives will be fixed as equal to total assessable income (excluding other income) multiplied with the percentage of revenue or expenses of the business entitled to tax incentives (Circular 78/2014/TT-BTC, Article 18, No. 2).

4 Circular 78/2014/TT-BTC, Article 18, No. 8.

5 Example: In 2019 Enterprise A incurred a loss of 1 billion VND from computer software production (entitled to tax incentives) but earned profit of 2 billion VND from trading activities (no incentives). The enterprise is permitted to offset the loss. The total taxable income is 1 billion VND. The applicable tax rate is the common tax rate (20%).

9.3.3 Preferential tax rates

A variety of preferential tax rates are applicable:

a) A CIT-rate of 10% for a period of 15 years to income:

• of enterprises from implementation of new investment projects2 in geographical areas3 with special socio-economic conditions, in economic zones and high-tech zones;

• from implementation new investment projects for scientific research and technological development, high-tech projects, computer software productions, infrastructure, renewable energies or other environmental projects;

• from new investment projects in production having either an investment capital of more than 6,000 billion VND plus a revenue exceeding 10,000 billion VND disbursed within the first 3 years of investment or an investment capital of more than 6 billion VND disbursed within 3 years and employing more than 3,000 people;

• of high-tech enterprises and agricultural enterprises applying high-tech technologies;

• of enterprises from implementing investment projects manufacturing products in the List of products of supporting industries prioritized for development either products of high technology supporting industries or products of supporting industries for manufacturing of textiles – garment, leather – footwear, electronics – information technology, automobile assembly, mechanical fabrication1;

• from implementing investment projects in the manufacturing sector2 with the minimum investment capital of 12,000 billion VND disbursed within 5 years3 and using technology evaluated in accordance with the Law on High-Tech and/or Law on Science and Technology.

b) A timely unlimited CIT-rate of 10% applies to income from:

• social education, social health, culture, sports, the environment, judicial expertise;

• social housing;

• planting, caring for and protecting forestry;

• agricultural, aquaculture cultivation and processing in geographical areas with difficult socio-economic conditions;

• cultivation of forestry products in geographical areas with difficult socio-economic conditions;

• producing, multiplying and hybridizing crop seeds and livestock breeds;

• preservation of post-harvest agricultural products and preservation of agricultural, aquaculture and food products;

• that part of the income earned from publication activities in accordance with the law on publication.

c) A CIT-rate of 17% for the period of 10 years applies to new investment projects in geographical areas with difficult socio-economic conditions; income from implementation of new investment projects in the field of production of high-grade steel, production of energy-saving products or agricultural machinery.

d) A timely unlimited CIT-rate of 17% applies to people’s credit funds and microfinance institutions.

e) A timely unlimited CIT-rate of 15% applies to income from cultivation, husbandry and processing in agricultural and aquaculture sectors not located in geographical areas with difficult or especially difficult socio-economic conditions.

The duration of the abovementioned preferential tax rates shall be calculated consecutively from the first year in which the enterprise generates turnover from the entitled activity. The duration of applicability of preferential tax rates may be extended for large scale and high-tech project, however, the duration of such extension shall not exceed 15 years.

________________________

1 Circular 78/2014/TT-BTC, Article 22.

2 ‘New investment projects’ are those must be granted with the first investment certificate from 1st January 2014 and generate revenue since the issuance date of the investment certificate (including those have been granted with investment certificate before 1st January 2014 but still in investment progress and have not operated, have not generated revenue, are granted with amended investment certificates from 1st January 2014; except for investment projects as a result of merger, division, de-merger, consolidation, conversion of ownership, etc. (Circular 178/2014/TT-BTC, Article 18, No. 5). Enterprises having investment projects from the result of merger, consolidation, etc., shall be entitled to inherit the CIT incentives of the former company/ investment projects for the residual period if they continue fulfilling the respective conditions (Circular 78/2014/TT-BTC, Article 18, No. 6 (a)).

3 A list of those geographical areas can be found in the appendix of Decree 218/2013/ND-CP.

9.3.4 Other incentives

Enterprises mentioned in clause a) of the previous chapter and enterprises investing in socialization activities in the sectors of education and training, vocational training, medical health, culture, sports environment and judicial expertise are also entitled to a tax exemption for a four-year period and a 50% reduction of the amount of CIT payable for a period of nine subsequent years.

Enterprises mentioned in clause c) of the previous chapter and enterprises having income from new projects in industrial zones1 are also entitled to a tax exemption for a two-year period and a 50% reduction of tax payable for a period of four subsequent years2 starting in the first year in which there is taxable income.

New investment projects in the socialization sector operating in areas other than those with difficult socio-economic conditions are exempt from CIT for a period of four years and entitled to a 50% reduction of the amount of CIT payable for a period of five subsequent years. Newly established enterprises with investment projects in areas with difficult socio-economic conditions are exempt from CIT for a period of two years and entitled to 50% reduction of the amount of CIT payable for a period of four subsequent years.3

The duration of the abovementioned tax incentives is calculated consecutively from the first year in which the enterprise generates taxable income from the activity entitled to the respective tax incentive.4

_________________

1 Except industrial zones located in geographical areas with favorable socio-economic conditions.

2 Law on CIT, Article 14, No. 2.

3 Decree 218/2013/NĐ-CP, Article 16 No 1, 2 and 3.

4 Example: If a company starts to generate turnover from an activity entitled to tax incentives in 2014 but firstly generates taxable income in 2017, then the period of its tax incentive shall start in 2017.

9.3.5 Example of tax incentive

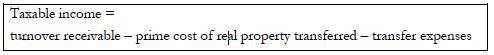

A newly established company producing in an Export Processing Zone (EPZ) is entitled to the CIT rate of 10% for 15 years, for income arising from implementing this new investment project.1

Additionally, a full CIT tax exemption for a 4-year period and a 50% reduction of the payable CIT for a period of 9 subsequent years are applied consecutively from the first year in which the company generates taxable income (profit) from the activity entitled to the respective tax incentive.2

In year 1 the project does not have any revenue and in the years 2 and 3 the project has revenue but no taxable profit. The taxation develops like this:

Effectively, the first 7 years are exempted from taxation and the following 9 years are limited to a taxation at 5%.

10. Creditability of foreign paid taxes

Income arising outside Vietnam is taxable in Vietnam and might also be taxable in the foreign country. The double taxation is avoided under the regulations of the relevant Double Taxation Agreements (DTA) or by means of a unilateral relief.

The unilateral relief is only applicable if the country in which such income is generated is not contractor of a DTA with Vietnam. An existing DTA prevails.3

10.1 Unilateral Relief

Taxes paid outside of Vietnam where such payment cannot be avoided (esp. by mechanisms under a DTA) will be deducted from the amount of CIT payable in Vietnam. The deduction is limited to the amount of tax payable on such income pursuant to the Vietnamese law.1

Losses from business activities outside Vietnam are not deductible from the taxable income in Vietnam.2

Two examples shall illustrate this. The Vietnamese company A is generating profit abroad without having a legal entity abroad.

Example 1: Vietnamese company A generates a foreign-sourced income of 1 billion VND. The applied foreign CIT rate is 15%. This income is taxable in Vietnam. The CIT paid in the foreign country is credited against the Vietnamese tax payable. The calculated CIT in Vietnam is (profit * 20% =) 200 million VND, the CIT paid abroad is (profit * 15%=) 150 million VND). 150 million are credited against 200 million and the remaining payable CIT is 50 million VND.

Example 2: As example 1, but the foreign CIT rate is 30%. The amount of tax payable in Vietnam is zero, because the foreign CIT is exceeding the Vietnamese CIT. The tax credit is limited to the tax under Vietnamese law, the foreign CIT cannot be credited against Vietnamese CIT from other income.

If the profit is generated via a legal entity registered abroad, the issue of avoiding of double taxation may arise regarding the distributed profits.

Example 3: Vietnamese company A generates 100 million VND income from dividends in a foreign country in 2016. The foreign country is withholding a tax on capital gains on this dividend payment. The full dividend3 will be taxed in Vietnam at 20%. The foreign CIT paid on the dividend can be credited against the CIT payable in Vietnam, up to the Vietnamese tax payable on that income (maximum deduction 20 million VND).4

_________________

1 Law on CIT, Article 13, No. 1 (a): “the CIT rate of 10% will be applied within 15 years for incomes of enterprises form implementing new investment projects in geographical areas with especially difficult socio-economic conditions, in economic zones, in hi-tech zones.”

2 Law on CIT, Article 14, No. 1.

3 Circular 78/2014/TT-BTC, Article 3, No. 1.

10.2 Double Taxation Agreements

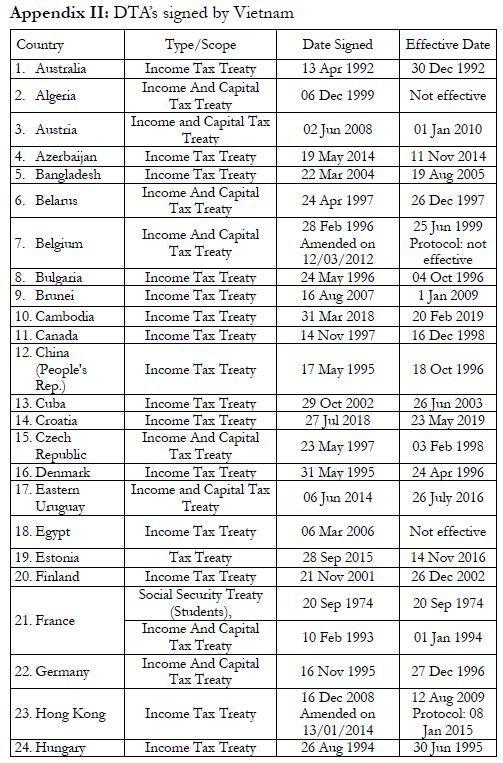

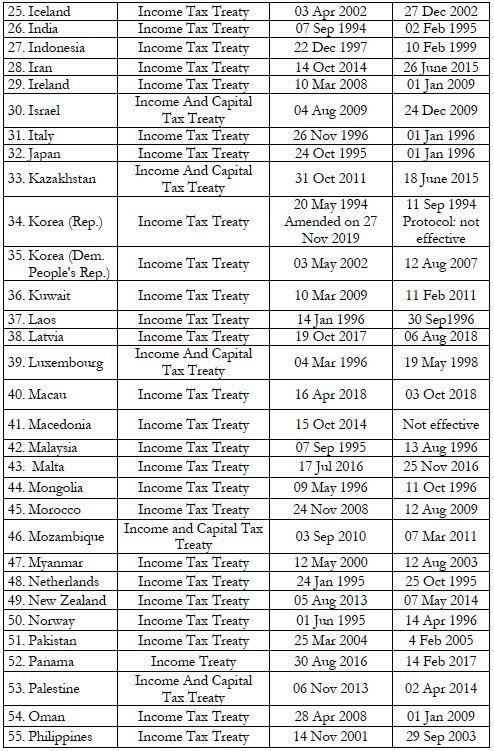

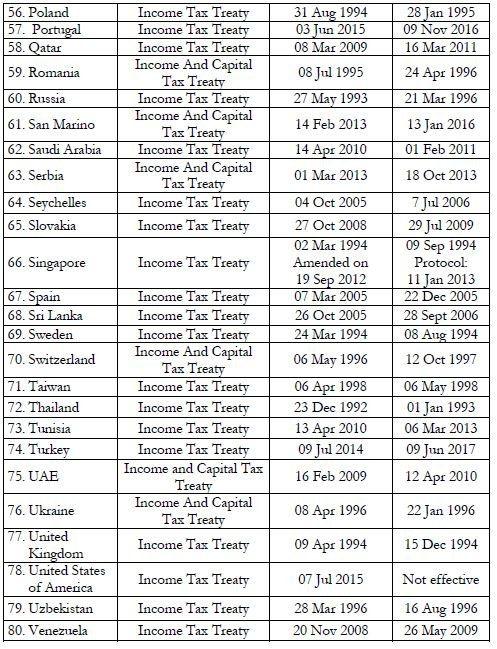

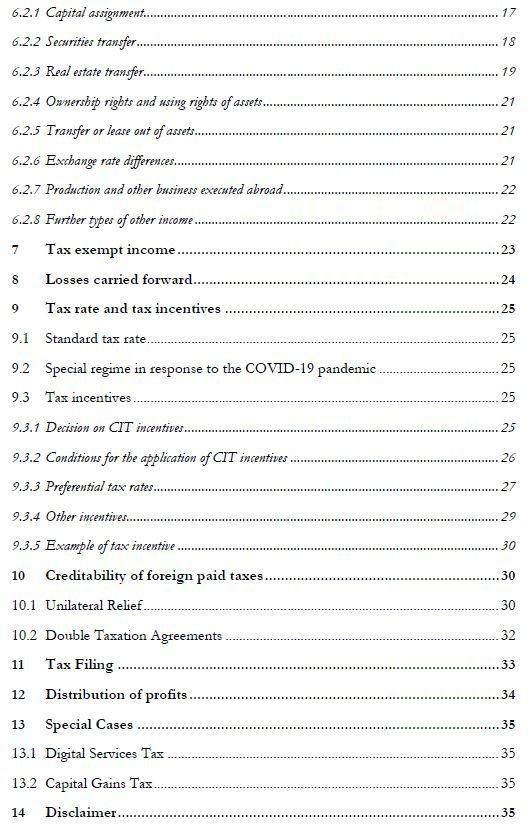

According to the relevant DTA, tax exemptions or reductions are applicable. Before they are applied, the foreign taxpayer must file related dossiers with the required information. Vietnam has signed 80 DTA’s, 76 are in force. For details, please refer to our Brochure on the FCWT. For the list, of DTA’s please see Appendix II: DTA’s signed by Vietnam.

Under most DTA’s, Vietnam will apply the principle of ordinary credit to avoid the double taxation of income derived outside Vietnam. Depending on the DTA, one or a combination of 3 following methods are applied:

➢ tax deduction method1,

➢ deduction method of deemed tax2,

➢ deduction method of indirect tax3.

Taxes paid abroad can be deducted from the domestic tax payable, but the amount of deduction is restricted to that part of the tax which is appropriate to the income that may be taxed in the other state. The principle does not differ from the unilateral relief.

The DTA’s therefore are mostly relevant for avoidance or limitation of CIT payable in the foreign country. This means, the focus of the Vietnamese taxpayer must be to apply the DTA exemptions of restrictions on the taxation abroad. This applies to the application of the foreign partner also but is not subject of this Brochure.

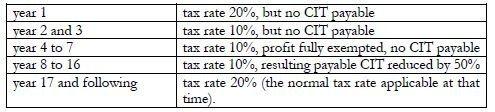

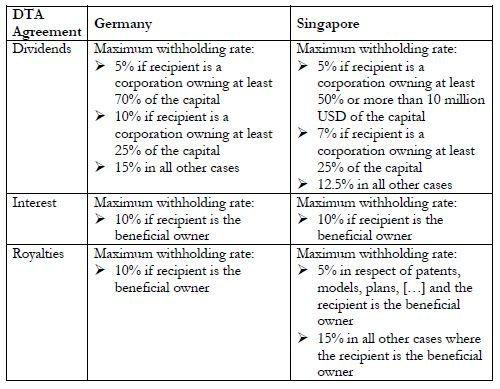

The DTA’s regularly restrict the percentage of tax on dividends, interest and royalties withheld by the country where the income is originating. Often, the DTA limits the tax withhold on dividends in the country of source to be 15%, 10% or 5% depending on the percentage of shares owned by the company receiving the dividends. The percentage of tax withhold on the payment of interest regularly is limited to 10%. The percentage of tax withhold on the payment of royalties usually is restricted to an amount of 15% (uncommon), 10% or 5%. To illustrate the above mentioned, examples based on the Vietnamese DTA arranged with Germany and Singapore will be given below.

________________

1 Circular 205/2013/TT-BTC, Article 48.

2 Circular 205/2013/TT-BTC, Article 49.

3 Circular 205/2013/TT-BTC, Article 50.

Table 2: Maximum withholding taxes on dividends, interest and royalties according to the Vietnamese DTA with Germany and Singapore

11. Tax Filing

The CIT finalization must be filed on or before the last day of the third month after the end of the calendar year or financial year, normally 31 March.

During the year, self-estimations of the CIT must be made and temporarily pay for each quarter no later than the 30th date of the first month of the following quarter. The total of temporally payment paid for the first three must not be lower than 75% of the resulting CIT according to annual finalization.1

12. Distribution of profits

After having declared and paid the CIT, the company can distribute the remaining profit to the shareholders.

Profit distributed to corporations registered in Vietnam or registered abroad is not subject to any withholding tax. For the receiving corporation registered in Vietnam this payment is tax exempted income.1

Profit distributed to individuals who are not the sole owner of an LLC are taxable under the regime of the Personal Income Tax (PIT). The profit distributing company must withhold PIT at the rate of 5%.2

The distributed profit is exempted from PIT in Vietnam, if the receiving individual is the sole owner of an LLC. If that person receives a salary from the LLC, the cost for that salary is non-deductible expense for the LLC but is taxable income of the individual under regime of PIT.

However, receiving the profit may be taxed in the country of residence (for the individual already taxed in Vietnam: a second time), depending on the domestic legislation and the underlying DTA.3 A double taxation should be avoidable.

13. Special Cases

13.1 Digital Services Tax

The digital services provided across the border are discussed as Digital Services Tax. They are as all other services subject to the FCWT. A specialized system for registration and payment for these cases is under consideration as well as specialized withholding rates. The Law on Tax Administration1 includes regulations forcing foreign e-commerce traders and providers of digital cross border services who do not have a PE in Vietnam to register with tax authority in Vietnam. Detailing regulations are expected to be issued soon.

13.2 Capital Gains Tax

The profit from capital gains is taxable under the regime of the CIT. The capital gain is to be recorded as other income2, namely income from capital assignment at chapter 6.2.1. Profit is equal to the transfer price minus the purchasing price of the transferred capital and the transfer expenses.

If a foreign entity is selling shares in a Vietnamese company the achieved profit is subject to the CIT in the form of the Capital Gains Tax. The buyer must calculate the resulting CIT on behalf of the seller, make the corresponding payment to the state budget and withhold the amount of tax from the payment to the seller.

If the buyer is also a foreign company, the Vietnamese company which ownership is transferred must declare and pay the CIT on behalf of the foreign seller.

A separate tax declaration is required.

______________________

1 Only mechanical fabrication which could not be domestically produced up to 01 January 2015 or domestically manufactured but meeting the technical standards of European Union or equivalent.

2 Except for manufacture of lines of goods subject to special consumption tax and mineral exploitation projects.

3 From the date of investment licensing.

14. Disclaimer

All information provided is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

No one should act upon such information without appropriate professional advice after a thorough examination of the facts of the particular situation. Liability claims regarding damage caused by the use or disuse of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected, if not generated deliberately or grossly negligent.