I. Introduction

The Regional Operating Headquarters (“ROH”) was originally introduced by the Thai Government on 16 August 2002 (hereinafter referred to as “original scheme”). After a long time of no improvements within the law of taxation on ROH, on 5 November 2010 new legislation was approved by the Crown and was published in Royal Decree Volume 127 Section 67 Gor on 5 November 2010 and published in the Royal Gazette on 8 November 2010 (hereinafter referred to as “new scheme”).

The new scheme was intended to boost investments temporarily and was only available until 14 November 2015. The original scheme still remains in force.

II. Definition of a Regional Operating Headquarters (ROH)

An ROH can either be an independent company incorporated under Thai law or an organizational unit of such a company. The business of an ROH is limited to the provision of services to their respective associated enterprises or branches in Thailand or abroad.

III. Services provided by ROH to its associated enterprises or branches that qualify for tax privileges

Services that an ROH provides to its associated enterprises or branches that qualify for tax privileges are managerial and administrative services, technical services, and supporting services. Supporting services include:

- General administration, business planning and coordination

- Procurement of raw materials and components

- Research and development of products

- Technical support

- Marketing and sales promotion planning

- Personnel management and regional training

- Financial advisory services

- Economic or investment research and analysis

- Credit control and administration

- Any other activity stipulated by the Director-General of the Revenue Department

As to the definition of associated enterprises, the Revenue Department has two criteria in determining whether or not a company can be considered as an ROH’s associated enterprise:

- Shareholding basis. A company shall be regarded as ROH’s associated enterprise if:

- The ROH holds at least 25 percent of that company’s issued capital; or

- The company holds at least 25 percent of the ROH’s issued capital; or

- The company holds at least 25 percent of the ROH’s and other company’s issued capital. In this case, the ROH and the other company are regarded as associated enterprises.

- Control basis. A company shall be regarded as an ROH’s associated enterprise if:

- The ROH has control over that company; or

- The company has control over the ROH; or

- The company, for example a holding company, has control over the ROH and the other company. If so, the ROH and the other company are regarded as associated enterprises.

IV. Regional Operating Headquarters under the legislation of 2002 (“Original Scheme”)

A company that wishes to operate as ROH under the original scheme can still register with the Revenue Department without any deadline as the original scheme is not timely limited.

1. Registration Requirements

The registration as ROH is possible for already existing and active Thai companies as well as newly founded Thai companies.

An already operating Thai company which is willing to obtain the ROH status and the advantages from it can apply for acknowledgement as ROH at the Large Taxpayer Office (“LTO”), the responsible tax authority. If the company meets certain requirements, the LTO will grant tax advantages automatically from the next tax period onwards.

If a Thai company wants to qualify as ROH, it has to apply for the acknowledgement as ROH together with the application for a tax number (Tax Identification Number = TIN) and the registration for Value Added Tax (“VAT”) at the Revenue Department.

2. Qualifying criteria for ROH (“Original Scheme”)

In order for an ROH to be eligible for tax benefits under the original scheme, it must fulfil the following conditions:

- The paid-in capital on the last day of the accounting period of the company amounts to a minimum of THB 10 million;

- The company has to provide its services and technical services to its branches or associated enterprises in at least three countries;

- Half of the company’s total income is derived from administrative, technical and other supporting services provided to its branches or associated enterprises in other countries and royalties received from outside of Thailand for the use of the ROH’s Research & Development (R & D). This criterion can be mitigated to one-third of the total revenue in the first three accounting periods of its operation as ROH. In case of force majeure, the Director-General of the Revenue Department may lower the income threshold for one accounting period;

- Notification of the Revenue Department of its incorporation as ROH. The benefits will be given starting from the notified accounting period onwards.

3. Tax privileges for ROH (“Original Scheme”)

ROH companies incorporated in Thailand under the original scheme enjoy the following privileges:

- Corporate income tax at the rate of 10 percent of net profits for income derived from services provided to the ROH’s foreign branches or associated enterprises;

- Corporate income tax at the rate of 10 percent of net profits for use of R & D done in Thailand by the ROH. This benefit is also extended to royalties received from a third party providing services to the ROH’s branches or associated enterprises using the ROH’s R & D;

- Corporate income tax at the rate of 10 percent of net profits on interest received from the ROH’s foreign branches or associated enterprises for loans granted, provided that such loans are made from other sources and extended to the ROH’s branches or associated enterprises;

- Tax exemption for dividends received from the ROH’s associated enterprises;

- Tax exemption for dividends paid out of the ROH’s concessionary profits to its shareholders not carrying on business in Thailand;

- Accelerated depreciation for buildings at the rate of 25 percent on the date of acquisition. The residual value can be depreciated within 20 years.

4. Tax privileges for expatriates working for an ROH company (“Original Scheme”)

Expatriates may choose to be taxed at the rate of 15 percent. By doing so, the income received must not be calculated together with other income. This privilege is available only to expatriates employed by the ROH and is limited to four consecutive years of employment in Thailand, regardless of how extensively the beneficiaries have to travel abroad during the employment period. To be entitled for the benefits once again, expatriates have to discontinue employment with any ROH company in Thailand for more than 365 days.

V. Regional Operating Headquarters under the legislation of 2010 (“New Scheme”)

A registration as ROH under the new scheme is no longer available since the new scheme expired on 15 November 2015.

VI. Practical notes

When calculating Corporate Income Tax, the ROH company has to separate non-qualified income from qualified income and its related expenses. If the expenses cannot be separated, the ROH company must apportion non-qualified and qualified expenses by the ratio of the received income. However, if such method of apportion does not reflect the reality of business, the ROH company may request approval of the Director-General of the Revenue Department to use other, more accurate and realistic ways of calculation.

Foreign companies that wish to be granted non-tax privileges given under the Investment Promotion Act in addition to the abovementioned tax privileges must apply for investment promotion privileges from the Board of Investment (BOI) BEFORE notifying the Revenue Department of their intention to register as ROH in order to be able to hold the majority of the shares in the ROH company. The BOI promotion provides additional tax and non-tax benefits such as[1]:

- Exemption of import duty on machinery for R&D and training activities

- Exemption of import duty on raw materials used in manufacturing export products for 1 year which can be extended as deemed appropriate by the BOI

- Land ownership

- Majority of foreign ownership

- Eased requirements for hiring of expatriates

_________________________

[1] The new BOI catalogue, effective from 1 January 2015, uses the term “International Headquarters” (Category 7.5).

VII. Conclusion/Recommendation

From our experience, particularly the requirement of five expats with THB 2.5 million salary or above is difficult to meet.

Compared to Singapore or Hong Kong, the legislation is still far more complicated without offering substantial additional benefits. Nevertheless, considering applying for an ROH does make sense if the main activities of the Company are in Thailand anyway and the regional function of the Thai organisation is to be increased.

________________________

[1] The new BOI catalogue, effective from 1 January 2015, uses the term “International Headquarters” (Category 7.5).

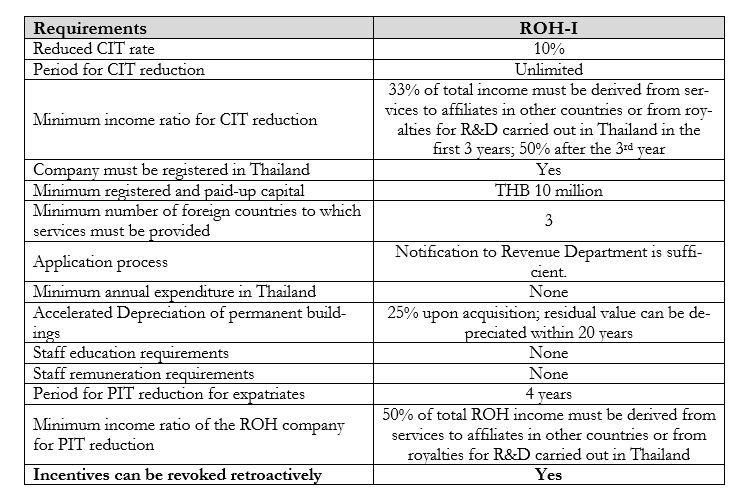

Annex I: ROH – Overview of Benefits and Requirements under the Original Scheme