I. Introduction

Investment in Vietnam has become even more attractive since Vietnam was granted accession to the World Trade Organisation (WTO) on 11th of January 2007, after a waiting period of 12 years. To comply with the requirements, the Vietnamese National Assembly passed a new Law on Investment (LOI), which became effective on 1st July 2006. The new LOI is an approach to treat domestic and foreign investors equally in most of the fields of investment.

The following paragraphs will highlight some of the main issues concerning investment activities in Vietnam. You will find a short description of the currently available investment vehicles, tax rates for Personal Income and Corporate Income Tax as well as the current minimum salary rates, labour regulations and land use issues.

II. Foreign Direct Investment and Available Entity Forms

1. Forms of Direct Investment

- Establishment of economic organisations, being 100% domestic or foreign owned;

- Joint ventures between domestic and foreign investors;

- Investment in the following contractual forms:

Business Co-operation Contract (BCC):

A contract signed between investors to co-operate in business and to share prof

its or products without creating a legal entity.

Build-Operate-Transfer Contract (BOT):

A contract between a competent State body and an investor. The investor shall construct and operate an infrastructure facility for a fixed period of time. After expiration of this period, the facility has to be transferred to the State of Vietnam.

Build-Transfer-Operate Contract (BTO):

In contrary to the BOT, the facility is transferred to the State of Vietnam after completion. The investor is granted the right to operate the facility for a fixed period of time to recover the invested capital and to gain profit.

Build-Transfer Contract (BT):

In contrary to BOT and BTO, the investor does not get the right to operate the facility. The Government, however, shall create conditions for the investor to implement another project, so that he can recover the invested capital and gain profit.

- Investment in business development;

- Purchase of shares or contribution of capital in order to participate in the management of investment activities;

- Investment in carrying out mergers and acquisition of an enterprise;

- Other forms of direct investment.

2. Available Entity Forms

a) Branch

A branch is a dependent subsidiary of a foreign entity which is permitted to perform all or a number of the functions of the enterprise in accordance with the Commercial Law and the international treaties of which Vietnam is a member.

A foreign company already existing 5 years which is specialized in the purchase and sale of goods or directly related services may open a branch in Vietnam.

The Ministry of Industry and Trade is responsible for the issuance of a branch licence. Within 15 days of the receipt of a complete and sound application dossier the license should be issued.

b) Representative Office (Rep. Office)

A Rep. Office is a dependent unit of the enterprise, having the task of acting as the representative in the interest of the enterprise and protecting such interests. The organisation and operations of a rep. office have to be in accordance with the law.

Rep. Offices shall only be used to evaluate the Vietnamese market and to prepare a market entry for activities of the foreign parent company. Direct business activity is not allowed. The head of the Rep. Office is, in this function, only entitled to sign contracts with regard to the employment of Rep. Office’s staff and its premises.

However, the head of the Rep. Office can be authorized to sign contracts on behalf of the foreign entity. But it should be taken into account that such authorizations can also lead to a possible tax exposure of the Rep. Office with regard to corporate income tax.

The Provincial Industry and Trade Services are responsible for the issuance of the license of a Rep. Office.

Within 15 days of the receipt of a complete and sound application dossier the license should be issued.

c) Limited Liability Company

A limited liability company (LLC) is an enterprise, in which its members are liable for the debts and other property obligations of the enterprise only within the charter capital. The law does not require a minimum charter capital. But the Investment Certificate will stipulate a Charter Capital which has to be in a reasonable relationship to the scope of the business. The number of its members is limited to a maximum of fifty.

A limited liability company is a legal entity. It obtains this status from the day of issuance of the Investment Certificate.

A limited liability company cannot issue shares. However, when a member has fully paid his share of capital contribution, he will receive a capital contribution certificate.

The day-to-day business is managed by the director. He may also in addition to act as the legal representative of the LLC.

In case of a Multi Member Limited Company MMLC the director or the chairman of the members council has to be the legal representative of the company.

A Single Member Limited Company SMLC is owned by one person or legal entity.

d) Partnerships

A partnership is an enterprise, in which two or more persons have united under one common name for a common purpose with the intent of sharing the profit thereof. In addition to unlimited liability partners there may be limited liability partners (capital contributing partners).

In a partnership, the partners are liable for the obligations of the company to the extent of all their assets. Limited partners are liable for the debts of the company only to the extent of the amount of capital they have contributed to the company.

A partnership under Vietnamese law is a legal entity. It will enjoy this status from the date of issuance of the Investment Certificate.

e) Shareholding Company

The procedure for setting up a shareholding company is similar to the set up of a limited liability company. The major difference is that a shareholding company is permitted to offer shares to the public.

f) Business Co-operation Contract (BCC)

Due to the fact that this investment vehicle only consists of a contract, the participating foreign and Vietnamese parties remain independent tax and liability subjects.

In order to limit the liability of the parties, the founding of a separate entity seems advisable. The legal base for this investment form is not detailed and therefore a significant number of major issues are rather unclear. Consequentially drafting the co-operation contract should be done with adequate care.

Mandatory contents of a BCC contract are: purpose, duration and scope of the co-operation; rights and obligations of the participating parties as well as procedures for the distribution of losses and profits.

One, at least theoretical, benefit of this investment form is the flexibility of the structure. The dissolution requires no more than a profit and loss distribution. From a practical point of view the dissolution is rather complicated, due to the independent book keeping of the BCC parties.

However foreign direct investments in certain sectors, i.e. telecommunication, have to be made in form of a BCC.

3. Forms of Indirect Investment

- Purchase of shareholding, shares, bonds and other valuable papers;

- Indirect investment through securities investment funds;

- Indirect investment through other intermediary financial institutions.

III. Taxes

Vietnam has entered into a considerable number of double taxation treaties (please consult Appendix I). However the implication of such treaties seems to be even more challenging in Vietnam than in other countries. Local tax authorities have a tendency to use a rather creative approach to the respective treaties and regulations. Therefore the co-operation with a locally well connected specialist is highly advisable.

1. Corporate Income Tax

The standard rate for corporate income tax is 25%. Depending on the scope of business, the business sector and the locality of the business establishment a considerable number of tax incentives can be applied for.

Preferential rates of 10%, 15% and 20% might apply for projects, if they are qualified for one or more of the following criteria:

- Investment in sectors where investment is encouraged, e.g. projects with a high export ratio or projects concerning infrastructure or afforestation;

- Investment in geographical areas, entitled to investment preferences;

- Investments in industrial parks or export processing zones.

In general, such preferential rates are only applied for a certain period of time reaching from 10 over 12 to 15 years.

In addition, tax holidays up to 4 years or a reduction of corporate income tax up to a period of 9 years may be granted to projects which meet at least some of the following conditions:

- Investment in encouraged sectors or areas;

- Projects having a certain number of employees;

- Investment in industrial zones or export processing zones;

- Newly established projects.

2. Personal Income Tax

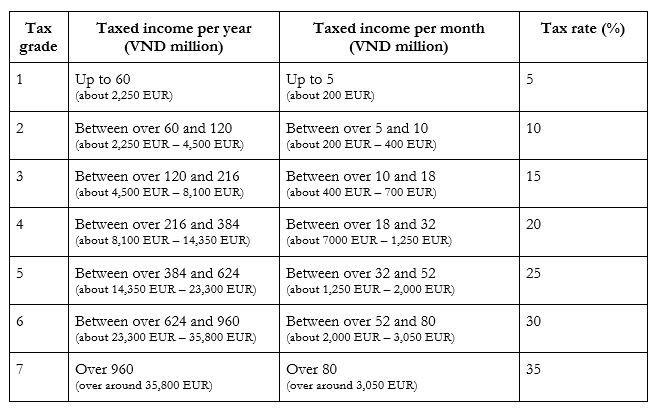

Foreigners in Vietnam are in principle subject to personal income tax. Foreigners staying for up to 183 days have to pay personal income tax on their income sourced in Vietnam. The applicable personal income tax rate is a flat tax rate of 20 %. Foreigners staying for more than 183 days are progressively taxed on their worldwide income on the basis of the following tax brackets:

IV. Labour Regulations

1. Minimum Wages

From 1 January 2013, the monthly minimum wages for workers have been raised to the following levels:

- In Hanoi and HCMC 117,5 USD;

- In the suburbs of Hanoi and HCMC as well as in Haiphong, Halong City, Bien Hoa, Vung Tau and other cities 105 USD

- In other areas from 82,5 USD to 90 USD.

The above stated salaries have to be paid to „simple“ workers. Workers who received a vocational training have to be paid an at least 7 % higher salary.

In comparison: minimum wages in:

Thailand: 291 USD (300 Baht / 9,72 USD per day);

Cambodia: 55 USD;

Shanghai: 230 USD;

Beijing: 200 USD.

2. Social Security and Health Insurance

Employers have to contribute to the Vietnamese social security system for all Vietnamese employees every month at a rate of 17% of the total wages of the employee. The employee also has to contribute to the system, however, only at a rate of 7%.

Furthermore, employers are obliged to pay for their Vietnamese employees health insurance premiums at a rate of 3% while 1.5 % have to be paid by the employee.

The contributions of the employer are exempt from personal income tax, since the Vietnamese tax law does not consider these contributions as taxable benefit to the employee. All expenses of the employee are deductible when computing personal income tax.

V. Land and Land use rights

“The ownership of land belongs to the entire people.” Therefore the land itself cannot be bought and is leased out or allocated by the government. Such land use rights are only available for institutional foreign investors and only valid for a restricted time period, in general 50 years. In exceptional cases the Prime Minister can extend the duration to a maximum of 70 years.

The current regime on land use rights, especially for residential housing is widely criticized by resident foreign investors as well as investors with Vietnamese origin (so called VietKieu, former emigrants or their offspring). However, only the latter may speculate upon a change in the policy on land and land use rights in the near future.

Usually a memorandum of understanding between the foreign investor and the landlord will be signed prior to the investment certificate application. Upon approval of the investment certificate, the respective land use rights will either be transferred to the foreign investor or a contractual connection with the landlord will be established.

The use of land use rights as loan security by foreign investors is almost impossible. Exceptional cases are certain industrial estates, i.e. Quang Trung Software City, where foreign investors are entitled to use land use rights as collateral.

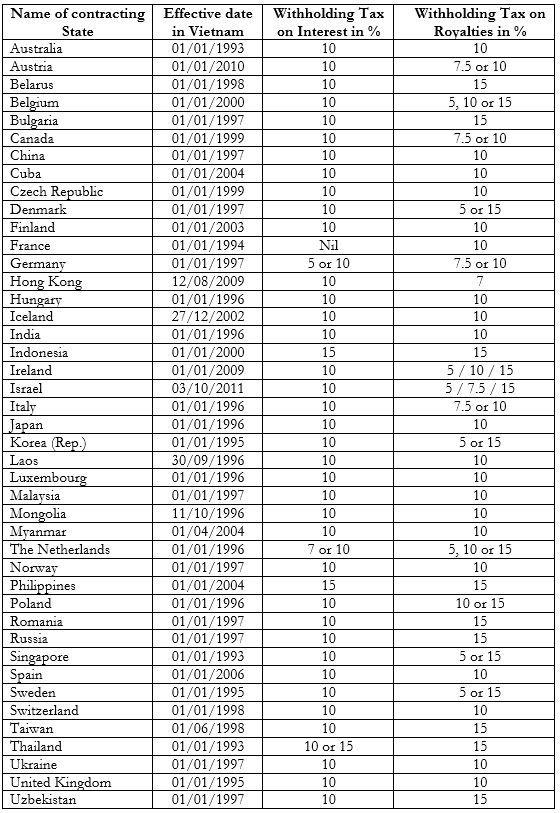

Appendix I: Some Double Taxation Treaties and Summary on withholding tax rates

The applicable withholding tax rate under domestic Vietnamese Tax law is 10% both for royalties and interest.

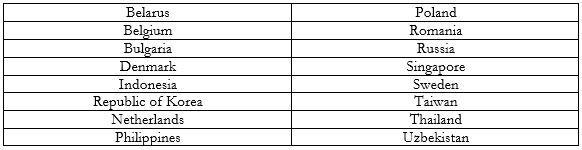

Whenever the rate under domestic tax law is lower than the maximum rate under the respective DTA, the domestic tax rates constitutes the maximum rate. This is the case for the following countries: