I. Introduction

In Hong Kong, personal income tax is known as “Salaries Tax” and is governed by the Inland Revenue Ordinance (IRO). Salaries Tax is only levied on the annual income of an individual deriving from their employment.

Income not generated through employment, such as accrued dividends or profits realised through the sale of shares, is not subject to taxation in Hong Kong.

Any employee’s income is subject to Salaries Tax, whereas income of a self-employed person is subject to “Profits Tax”.

II. General Information

- Territoriality Principle

Salaries Tax only applies to income arising from or generated through employment in Hong Kong. This is known as the Territoriality Principle.

Section 8(1) IRO:

(1) Salaries tax shall, subject to the provisions of this Ordinance, be charged for each year of assessment on every person in respect of his income arising in or derived from Hong Kong from the following sources-

(a) any office or employment of profit; and

(b) any pension.

The definition of income in this context includes remuneration, salary, allowances, bonuses and amounts representing the employer’s voluntary contributions into pension funds, therefore excluding employer’s mandatory contributions in accordance with the Mandatory Provident Fund Scheme

(MPF). Achievements from pension funds which are not established under the jurisdiction of Hong Kong as well as severance payments and long service payments on termination of employment are also excluded.

- Taxation rates in Hong Kong

There are two different methods of computing Salaries Tax. It is the taxpayer’s right to opt for the alternative which leads to a lower tax burden:

- a flat tax rate of 15 % on the assessable income after all deductions; or

- a progressive tax rate levied on the assessable income after the deductions of expenses and allowances.

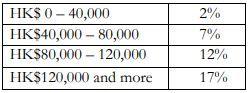

The progressive rates for the assessment years 2016/17 are as follows:

III. Salaries tax for services rendered offshore

- General view of Hong Kong’s Inland Revenue Department (“IRD”)

When determining whether Hong Kong is the “source” of a person’s employment for Salaries Tax purposes, the IRD takes the following three factors into consideration:

- where the contract of employment was negotiated and entered into, and is enforceable; and

- the place of residence of the employer; and

- the place of payment of the employee’s remuneration.

If all three conditions are fulfilled, the IRD will assume Hong Kong is the source of employment, thus subjecting all income arising out of such employment to taxation in Hong Kong.

The Hong Kong tax authorities will examine each individual case carefully. In case a taxpayer objects to the assessed tax, it is likely that the IRD will demand substantial documentation supporting the view of the taxpayer.

The IRD will normally determine a Hong Kong employment if the employer is a Hong Kong resident, even though the contract of employment might have been negotiated and signed in another country.

The Board of Review, as the independent appellate body of the IRD, issued the following opinion in the case of an employee from the USA, employed by a Hong Kong company, whose employment contract was negotiated, signed and finalised in the USA:

“He (the employee) was not employed by any company in the United States and he was not subject to any master-and-servant relation with any United States company. His master-and-servant relation was clearly with the company in Hong Kong with whom he entered into an employment contract. In the circumstances of this case the fact that he was physically in the United States when he received the employment contract is not material.[1]”

- Services rendered offshore

Hong Kong’s tax law provides clear regulations on taxation of income derived from services rendered outside Hong Kong:

Section 8(1A) (b) IRO:

(1A) For the purposes of this Part, income arising in or derived from Hong Kong from any employment:

(a) […]

(b) excludes income derived from services rendered by a person who-

(i) is not employed by the Government or as master or member of the crew of a ship or as commander or member of the crew of an aircraft; and

(ii) renders outside Hong Kong all the services in connection with his employment; and

(c) excludes income derived by a person from services rendered by him in any territory outside Hong Kong where-

(i) by the laws of the territory where the services are rendered, the income is chargeable to tax of substantially the same nature as salaries tax under this Ordinance; and

(ii) the Commissioner is satisfied that that person has, by deduction or otherwise, paid tax of that nature in that territory in respect of the income.

Consequently, remuneration paid in Hong Kong deriving from services rendered outside Hong Kong is exempted from Salaries Tax, however, only if the salary has actually been taxed in a foreign jurisdiction.

- Deductions and allowances

Hong Kong’s general tax rate is one of the lowest in the world. Therefore, tax deductions are only available to a limited extent. There are three types of tax deductions available in total:

- Outgoings and Expenses;

- Concessionary deductions, and

- Allowances (not applicable for taxpayers paying the flat tax rate).

Deductible expenses in the assessment period 2016/17 are

- charitable donations up to 35% of the personal income;

- residential care expenses for parents and grandparents up to HKD 46,000 per year (the parents/grandparents must be aged 60 or above);

- home loan interest up to HKD 100,000 per year, limited to a maximum of 15 years;

- mandatory contributions to recognized retirement schemes up to HKD 18,000 per year;

- depreciation on factories and machines, which are necessary for earning personal income;

- personal allowance in the amount of HKD 132,000 (singles) and HKD 264,000 (married persons);

- child allowance in the amount of HKD 100,000 for each child and an additional allowance of HKD 100,000 in the year of birth;

- single parent allowance HKD 132,000;

- dependant parent, dependant grandparent, dependant brothers and sisters allowance ranging from HKD 46,000 to HKD 80,000, depending on the age of the parents/grandparents/siblings;

- disabled dependant allowance HKD 75,000;

- Expenses of self-education HKD 100,000.

V. Housing Benefits

- Introduction

Housing Benefits are not deductible from tax, which is a factor that has to be considered when calculating an individual’s taxable income.

Further, if the employer pays the rent for an apartment in Hong Kong and provides it to his employee rent-free during the term of their employment, the rental value will be included in the employee’s taxable income:

According to Section 9(1)(b)(c) IRO, the rental value is part of the employee’s taxable income:

(1) Income from any office or employment includes-

(a) […]

(b) the rental value of any place of residence provided rent-free by the employer or an associated corporation;

(c) where a place of residence is provided by an employer or an associated corporation at a rent less than the rental value, the excess of the rental value over such rent; […]

The law makes a distinction between cases in which the employee’s residence is provided by the employer 100 % rent-free, as opposed to cases in which it is provided for less than the normal rental value.

- 100% rent-free

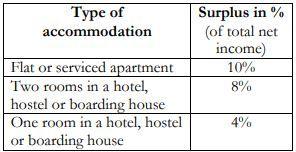

In cases where the residence is provided 100% rent-free, the rental value to be added to the taxable income will depend on the type of accommodation provided.

If the residence provided is shared by more than one employee, the surplus rates for a hotel, hostel or boarding house apply.

- Provision for less than the normal rental value

In cases where the employer provides residence to the employee for rent less than the normal rent, the difference between the normal rent and the rent actually paid by the employee is added to the employee’s taxable income (Section 9 (1)(c) IRO).

[1] Case No. D8/92, 7 IRBRD 107.