I. Introduction

The promotion discussed in this newsletter was developed from privileges for Regional Operating Headquarters (“ROH”) which the Thai Government issued on 16 August 2002. The ROH scheme, however, has never been popular amongst investors because the regulations and requirements were difficult to understand and the promoted business activities were limited.

Therefore, the Thai Cabinet approved a new investment promotion scheme for International Headquarters (“IHQ”) on 23 December 2014 which was formally announced by Royal Decrees No. 586 dated 28 April 2015 and came into effect on 01 May 2015.

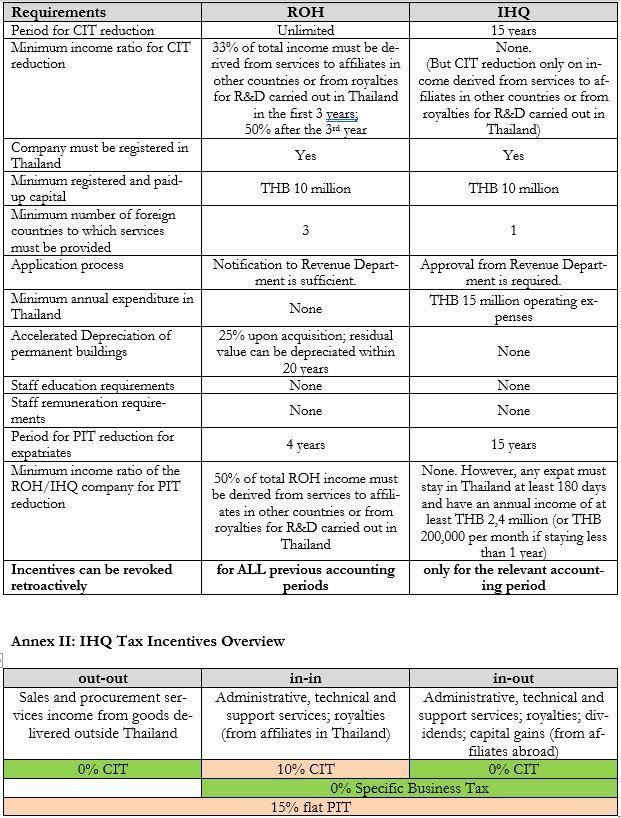

Companies doing business in Thailand can either register for ROH or for IHQ status.

II. Definitions

An ROH can either be an independent company established under Thai law or an organisational unit of such a company. The business of an ROH is limited to the provision of services to their respective associated enterprises or branches in Thailand or abroad.

An IHQ is a company registered in Thailand providing management, technical, financial or support services to its associated enterprises or branches in Thailand or abroad (“affiliates”), or international trade centres and therefore are permitted to operate as IHQ.

An “associated enterprise” is defined as follows:[1]

- A company that directly or indirectly holds at least 25% of the IHQ’s total issued shares;

- A company in which the IHQ directly or indirectly holds at least 25% of the total issued shares;

- A company that directly or indirectly holds at least 25% of the total issued shares of a company under 1);

- A company that has the power to control or supervise the operation and management of the IHQ;

- A company in which the IHQ has the power to control or supervise the operation and management; or

- A company that has the power to control or supervise the operation and management of a company under 4).

III. Qualifying Criteria

In order to qualify for tax privileges, an IHQ must fulfil the following criteria:

- Registered and fully paid-up capital of at least THB 10 million; and

- Annual expenses in Thailand of at least THB 15 million; and

- Provision of services to at least one associated enterprise outside of Thailand.

Services that an IHQ provides to its affiliates that qualify for tax privileges are managerial financial and technical services, as well as supporting services. Such services include e.g.:

- Organizational administration and management and business planning;

- Sourcing of goods;

- Research and development;

- Technical support;

- Marketing and sales promotion;

- Human resources and training management;

- Business advisory services, e.g. financial management, marketing, accounting system etc.;

- Economic and investment analysis and research;

- Credit management and control;

- Treasury centre;

- Any other activity stipulated by the Director-General of the Revenue Department.

If an IHQ fails to fulfil any of the criteria, it will be disqualified from tax incentives for the relevant accounting year only (unlike an ROH which would be considered disqualified from the beginning and liable for all taxes and surcharges retroactively).

IV. Tax Privileges

An IHQ that meets the aforementioned criteria will be granted the following tax privileges for up to 15 years:[2]

- Exemption from corporate income tax (“CIT”) on:

- profit derived from procurement and sales of goods outside of Thailand (“out-out”);

- profit derived from services provided to affiliates abroad (“in-out”);

- income from dividends and royalties derived from affiliates abroad;

- capital gains derived from transfers of shares in affiliates abroad (if capital gains are calculated as prescribed by the Revenue Department).

- Reduced CIT of 10% on:

- profit derived from services provided to Thai affiliates (“in-in”);

- royalty income derived from affiliates in Thailand.

- Exemption from withholding tax for payments to companies established abroad and not doing business in Thailand on:

- Dividends paid to the IHQ’s corporate shareholders abroad (provided such dividends are paid out of the IHQ’s net profits or income that is exempt from CIT);

- Interest paid to companies abroad (provided such interest is paid on loans that are taken out by the IHQ for the purpose of providing loans to affiliates in Thailand or abroad).

- Exemption from specific business tax[3] on interest income derived from loans to affiliates in Thailand or abroad for its financial management.

- Reduced personal income tax (“PIT”) of 15% flat for expatriates who work for the IHQ, receive a minimum salary of THB 2.4 million per year and reside in Thailand for at least 180 days in each tax year. This tax privilege is applicable in the years when the IHQ receives tax benefits.

When calculating the CIT, the IHQ has to separate non-qualified income from qualified income and its related expenses. If the expenses cannot be separated, the IHQ must apportion non-qualified and qualified expenses by the ratio of the received income. However, if such method of apportion does not reflect the reality of business, the IHQ may request approval of the Director-General of the Revenue Department to use other, more accurate and realistic ways of calculation.

- Approval Process

In order to obtain the benefits mentioned above, an approval needs to be obtained from the Director-General of the Revenue Department.

Existing ROH companies can file an application to register as IHQ and can terminate their ROH registration without having their ROH tax privileges suspended retroactively.

- BOI Promotion

Apart from the above privileges, the BOI grants additional tax and non-tax benefits such as:

- 100% foreign ownership;

- Land ownership;

- Exemption of import duty on machinery (only on machinery for R&D and training activities); and

- Eased requirements for hiring of expatriates.

VII. Conclusion

Thailand is competing with neighboring countries for foreign investors who are seeking to establish their trading hub in Southeast Asia. Hong Kong and other tax havens use the so-called “Territorial Tax System” which levies CIT only on income sourced within the country. Thailand, on the other hand, uses the so-called “Residential Tax System” which means that companies that are registered in Thailand have to pay CIT on their worldwide profits. By granting tax incentives to IHQs – and thereby de facto granting an exemption from the Residential Tax System – Thailand is trying to attract more foreign investment. The straightforward provisions (compared to the relatively complicated restrictions and requirements under ROH scheme) are expected to attract more foreign investors who may consider Thailand as an attractive country to set up their international operations hub.

[1] Section 3 of the Royal Decree No. 586 B.E. 2558.

[2] Please also see the overview in Annex II.

[3] A specific business tax in the amount of 3.3% is applicable to any interest derived from a loan extended by one Thai company to another company.

Annex I: ROH vs. IHQ